Here’s the 5 best accounting software for small business UK to help you decide which is best for you. If you know what you’re looking for, use our free tool to compare the best accounting software.

In this guide…

- Why Use Accounting Software?

- 5 Best Accounting Software For Small Business UK

- Sage

- Quickbooks

- Xero

- FreeAgent

- ClearBooks

- Things To Consider Before You Buy

Why Use Accounting Software?

If you want to save yourself bags of time, automating your bookkeeping and payroll system could save you a ton of money.

As well as saving you money, there are are many other benefits to using of the best accounting software for small business UK.

For example, you can access your financial statements through mobile apps, send invoices, and pay any bills to keep your business ticking over wherever you are in the world

Here’s the 5 Best Accounting Software For Small Business UK

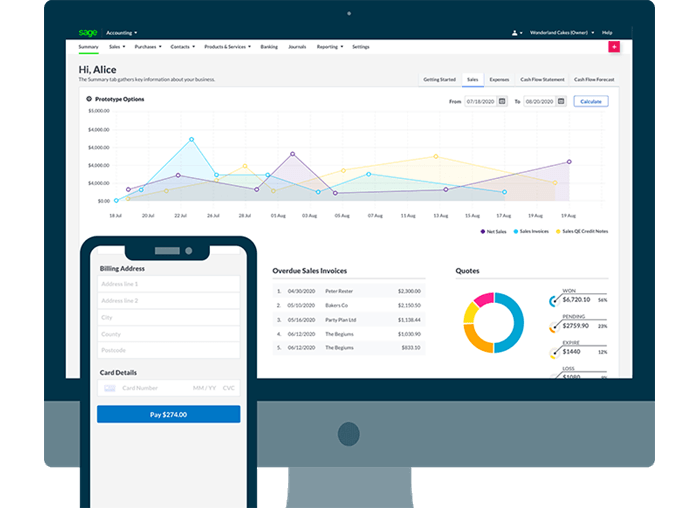

Sage Accounting

Key Features

Sage provides a very comprehensive reporting system, giving you an overview of all your financial information. It is easy to use and align with your businesses bank accounts.

As a standard, you’ll get access to Sage’s invoicing and estimates system, where you can track, and manage all your payments in one place.

Plus Sage also lets you photograph and upload receipts from all your transactions, enabling you to seamlessly connect your finances to your bookkeeper in a matter of seconds, also meaning you don’t have to faff around with pieces of paper.

Plus Sage will also record and calculate all your VAT, and tax returns at the click of a button, without the hassle of going through all your old invoices.

Sage may be one of the best pieces of kit for businesses with several employees as employers can manage their employees easily using Sage’s HR management tool which automates annual leave, shift schedules, tracks timesheets, and looks after your expenses for you, something a lot of other online accountants don’t cater for.

You can also use Sage on the go with its streamlined mobile app! Here’s our Sage review.

Check out Sage Accounting latest deals. In our opinion, Sage is the best accounting software for small business.

Sage Trustpilot

Sage is well rated on Trustpilot with 85% of its reviews being Excellent, citing great feedback on its customer support teams.

Compatibility and Integrations

Unfortunately sage does not support PayPal, but it does support Stripe helping you to get paid faster when you invoice your clients.

You can also link your Google accounts up to your Sage account to export all your invoices and quotes onto a cloud storage device for that added data security.

Pricing

One of the bonuses of Sage is that you get a 3-month free trial on all of its accounting plans as soon as you sign up to use the software, a great money saver for the smaller businesses out there.

Its base plan is slightly more expensive than most of the other online accountants on this list, costing £12 per month, but with that, you can send unlimited invoices, track what you’re owed, and calculate your tax.

One downside is that you cannot send out unlimited quotes and estimates like you can through QuickBooks’ base plans. And the more expensive plans coming in at £24 and £30 per month are also tailored towards larger business, with the mid-range package giving you unlimited users, allowing you to run advanced reports, send out estimates, and forecast your cash flow.

The upper-tier adds on just two more features, giving users access to multiple currency support and inventory management tools.

Overall Sage is a pretty good value for money service. It lets itself down when it upsells on extra payroll and HR features, with its payroll feature costing £7 per month, and its HR software being more expensive depending on the number of employees on your books.

Click here to see the latest offers from Sage.

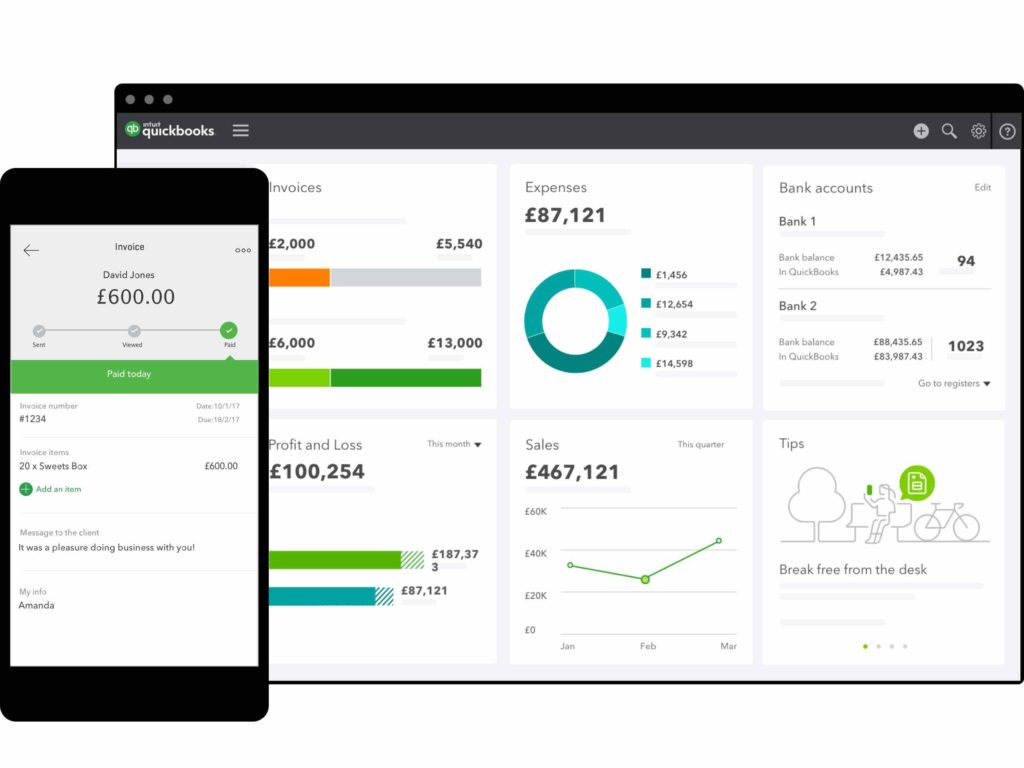

QuickBooks

Key Features

QuickBooks has a wealth of features you can use to automate your business accounts and save a ton of money.

It will also track and log all your incomings and outgoings after you’ve connected the account to your bank, and provide you with up-to-date metrics on your profit and loss statements.

Its smart invoicing feature lets you build invoices quickly, even on its mobile app, and send out payment requests to all your clients.

What’s more is it will track, chase, and manage each invoice for you and will also turn accepted estimates into invoices for you at the click of a button.

Quickbooks also comes with a 90-day liquidity forecaster that will help you anticipate the highs and lows of business life, taking into account your current bills, outstanding invoices, and tax commitments to help you prepare for the months ahead.

It’s expenses and mileage tracking systems scream efficiency, enabling you to take photos of any receipts and upload them straight into your Quickbooks account, appearing on your balance forecasts straight away.

The QuickBooks app also comes with a cool mileage tracker, that accurately uses your GPS location to track how far you’ve travelled to and from a job so you can recover the correct amount of money from your fuel expenses.

Check out Quickbooks latest deals. Here’s the full Quickbooks review.

Quickbooks Trustpilot

QuickBooks has an 81% excellent Trustpilot rating with many reviews citing great customer service and great usability.

However multiple users have reported issues linking their bank accounts to the software and others stated the service lacked a clear cancellation process.

Key Fact

Approximately 85-90% of small businesses use QuickBooks in the USA, with over 50,000 U.S. Accountants participating in QuickBook’s ProAdvisor program, that integrates professional accountants to the online service, allowing users to gain greater financial advice on the platform.

Compatibility and Integrations

QuickBooks is compatible with over 650 different business applications, you can connect it to PayPal for online payments, connect it to Square to manage your point of sale funds and inventory, and connect it to Shopify, to automate all the figures and costs associated with your online store.

QuickBooks is also compatible with pretty much most banking organisations.

Pricing

QuickBook’s plans all come with a 6 month half price deal as soon as you sign on.And even after that its plans are still reasonably well priced offering a slightly better value for money service than Sage.

Small and medium-sized businesses will benefit from QuickBook’s Simple and Essentials plans costing £12 and £20 per month respectively and come with a wealth of accounting features suitable to helping you manage your cash flow.

The Plus plan provides you with the tools you need if you’re setting up a slightly larger business or online store, with stock management, time-tracking, and project management features included for £30 per month.

The best feature about Quickbooks is that it caters to sole traders offering them an exclusive Self-Employed package at a very affordable £8 per month, that assimilates all your tax information for you, meaning you won’t have any nasty scares when you come to do your self-assessment at the end of the year.

QuickBooks is guilty of upselling, adding an extra £4 per month if you’re looking for payroll features, or £6 for time tracking packages.

Check out the latest deals from Quickbooks.

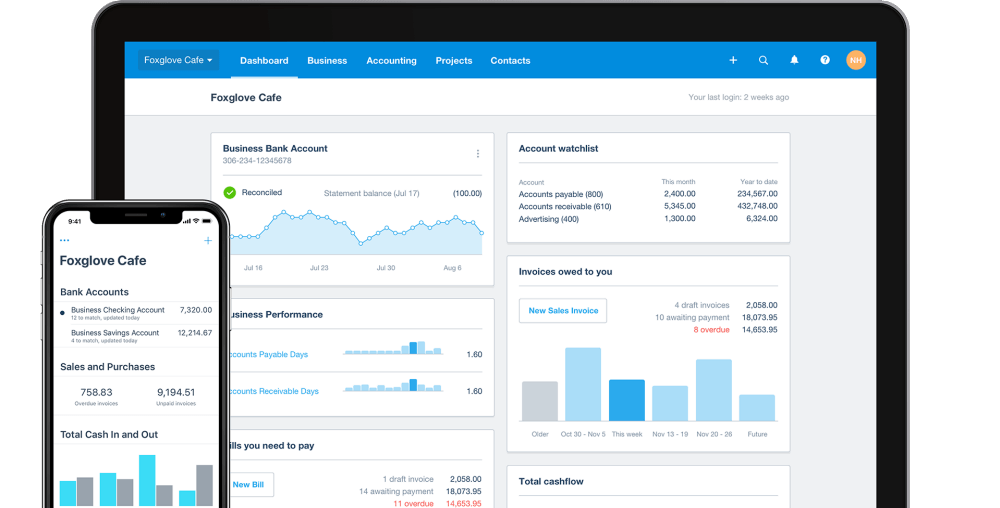

Xero

Key Features

Xero has a wealth of features that aren’t too dissimilar to QuickBooks. One thing that Xero does well is its presentation and usability.

The mobile applications and desktop interface are both slick and crisp letting you see and access your financial information in a presentable and easy to read format.

Plus on each of its plans, Xero allows unlimited users, making it the perfect option for larger businesses with multiple persons looking to access your companies accounts at any one time.

Xero offers the widest array of features at its top-end plan.

For example, you can use Xero to send out repeat invoices, create expense claims by taking photos of all your receipts and use its mileage tracker to calculate your fuel costs and use its inventory tracker to keep an eye on all your stock if you’re running an online shop.

But Xero is a bit cheeky and upsells a lot, requiring users to pay extra for its payroll feature, its expenses tracking software, and its project management software.

Xero Trustpilot

Xero has a poor Trustpilot rating with only a 54% excellent rating. Although many people do state that the software is slick and easy to use, many also cite it as having slow customer service, and others say that it doesn’t provide the best value for money for small businesses.

Key Fact

At the end of July 2020, Xero had a total number of 2.3 million subscribers on its books, showing that it is a very well trusted and reliable service.

Compatibility and Integrations

You can integrate over 800 applications, banks, payment gateways and online platforms with Xero.

What’s also cool is Xero also has its own App Marketplace where you can download a wealth of apps you can download and use to automate your business admin, like Stripe, Pay with TransferWise, and WorkflowMax.

And similar to QuickBooks, Xero is pretty much compatible with most banks, but we’d recommend using it alongside TransferWise for the most streamlined user experience.

Pricing

Xero doesn’t pack in the best value for money and is only really worth purchasing if you’re a larger entity looking to subscribe to either its £24 per month standard, or £30 per month premium plan.

Its base plan starting at £10 per month is simply not worth the price as it only lets you send out 5 invoices and quotes, enter 5 bills and reconcile 20 bank transactions.

FreeAgent

Key Features

FreeAgent makes it super simple to keep a track of your businesses’ finances with its automated cloud accounting software that tracks every payment and expenditure on your company account.

The software notes what you’re owed and will automatically chase up annoying late invoice payments for you, enabling you to get paid faster.

Unlike other accounting software, FreeAgent includes time tracking tools in each of its plans, enabling you to see how much time you’re billing and be certain that you’re billing your clients the right amount of cash.

And when it comes to tax, FreeAgent will automatically generate your tax return from your bookkeeping data meaning you’ll never have a nasty scare when it comes to filing your self-assessment at the end of the year.

Plus the system easily integrates with HMRC making it super easy to submit your tax returns.

You’ll also get FreeAgent’s payroll systems included as standard with its accounting packages, meaning you will be able to remain compliant with PAYE obligations, keeping all your employes paid and are up-to-date on their payslips.

This is the only accounting package on this list that includes payroll features that don’t come at an additional cost.

FreeAgent Trustpilot

82% of its Trustpilot reviews report an excellent service from FreeAgent, but some reviews did state that it was difficult at times to contact support agents, and said the software was “expensive”.

Compatibility and Integrations

Unfortunately, FreeAgent only caters to three different types of business packages and therefore isn’t very scalable should your business start to grow.

But FreeAgent integrates well with a whole host of applications and payment systems, like Shopify, HMRC, and a variety of banking institutions.

FreeAgent Pricing

Similar to QuickBooks, FreeAgent offers 50% off for your first 6 months subscription. And for all of their plans, you’ll get unlimited invoicing, unlimited users, and unlimited projects making FreeAgent one of the best value for money services going.

FreeAgent has three main plans that are split up for sole traders, partnerships, and limited liability companies.

This is one of the best features about FreeAgent, as it means you’re not spending excess money on features you won’t use, but have a plan that is tailored to your business needs.

The Sole Trader plan starts at £19 per month, followed by the Partnerships plan which costs £24 per month, and lastly the Limited Company plan, costing £29 per month.

Apart from the Sole Trader plan, which is pretty expensive when you compare it to Quickbooks’ £8 equivalent, FreeAgent price their plans well for the features that are included.

Here’s our full FreeAgent review.

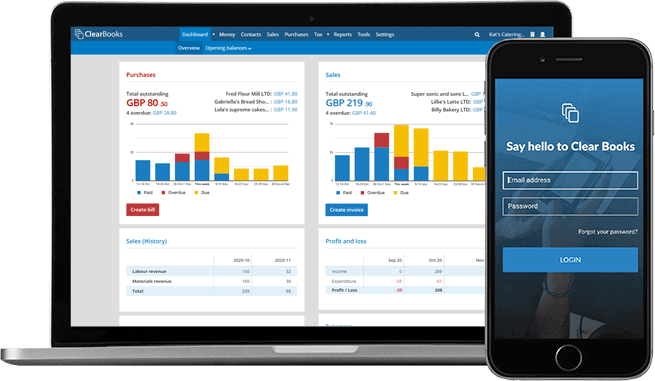

ClearBooks

Key Features

Firstly, although its dashboard is slightly dated, it does a good job of presenting you with your profit loss and sales reports, as well as your tax pots.

The software also lets you create your custom invoices, allowing you to pick from 20 templates, and is fully customisable meaning you can add a logo or any other information you need on the invoice.

One innovative feature is its Contact Management database, which allows you to manage customers and record their information, invoice preferences, and bank details, so you can quickly recreate invoices that can be tailored to the needs of your customer, helping you get paid faster.

ClearBook’s project management feature also enables you to generate reports and track in real-time how projects are progressing.

You can use this tool to record time spent on a project, but the only downside is you can’t add expenses to these time files.

Plus ClearBooks offers very comprehensive VAT support for those looking to submit their VAT at the end of the year.

It is streamlined with HMRC making tax digital systems, so you can submit your tax returns directly to the government without any annoying paperwork.

ClearBooks Trustpilot

The platform doesn’t have the best Trustpilot rating, coming in with 61% excellent reviews, some of whom cite the software to be “intelligent” and “intuitive,” but many others also say that the software is hard to navigate.

Compatibility and Integrations

Although the ClearBooks integrates well with HMRC and Companies House to file your taxes, it is really limited elsewhere on the other applications you can link to it.

It only offers 18 integrations which are seriously limited compared to the likes of Xero with its huge App Marketplace.

Pricing

By far the best value for money plan on this list. You can start using its free Micro plan, which records your sales, bills, expenses, bank transactions and gain some basic support on your VAT repayments.

And if you’re opting for one of its paid plans, you’ll get 50% off your first 3 months subscription! ClearBooks only has two pricing plans making it very easy to decide which is the best for you.

But as always, we recommend starting with the Small plan, priced at £10 per month.This plan is great for any small business allowing you to build invoices, quotes, track your bills and financial statements reports, and use its project accounting tool also.

If you’re running a slightly larger business you might want to take a look at the Large plan which is only £22 per month and enables you to report your VAT repayments to HMRC and work with multiple currencies.

Even though it is a cheap alternative it does upsell on its payroll and HR software charging a base price of £5.40 per month, which will increase by £2.70 for every three employees you add.

5 Things To Consider Before You Buy Accounting Software

Consider these things and you’ll find it much easier to find the best accounting software for small business UK.

Value For Money

Although perhaps cheaper than most traditional accounting firms, online accountants are still a big expense, particularly for sole traders and small businesses.

You’ll want to be sure that you’re getting the best bang for your buck, so make sure you look at the features each platform is offering, and assess whether the cost is worth the price.

Does It Suit Your Businesses’ Needs?

You’ll also want to do your research and check whether the features an online bookkeeper offers are suitable for your business.

There’s no point in joining on a plan that provides you with partnership dividend features if you’re a sole trader.

Assess your business needs first and match them up to the right accountancy plan for you.

Scalability

As your business grows, you’ll find you’ll need more and more accounting features.

For example, you may hire two employees and have to start up a payroll scheme, or you might find your small online shop growing into a huge online marketplace.

Look for the best plan that will cater to your growing business needs and will allow you to opt into more features as you need them.

Efficiency And Ease Of Use

Technology can sometimes be a massive pain.

Particularly when you’re handling large quantities of information, it can be frustrating when you cannot find what you need or can’t navigate a tricky bit of software.

That’s why it’s always great to pick the platform that is easy to navigate and lets you see all your finances clearly.

Tax Filing

Because no one wants a surprise tax bill at the end of the year.

You’ll want to ensure that the platform you’re opting into can provide you with the most appropriate tax filing systems for your business.

If this guide to the best accounting software for small business UK helped you, please recommend DigitalSupermarket.

For an alternative to accounting software, check out Osome.

When making any financial transaction online, we recommend using a VPN service for extra security. Compare VPNs to find what’s best for you.