There are many different cloud accounting software providers available. FreeAgent is one of the best for small business. In this FreeAgent review we’ll show you why we think so.

In this FreeAgent review…

- What is FreeAgent?

- Why FreeAgent?

- FreeAgent review: Features

- FreeAgent review: Trustpilot

- FreeAgent Prices

- FreeAgent vs Xero

- FreeAgent vs Xero Verdict

- FreeAgent vs Quickbooks

- FreeAgent review: Conclusion

With the invention of cloud bookkeeping software like FreeAgent, accounting no longer has to be a time-consuming chore. When starting a business, it’s incredibly important to keep track of your expenses.

Likewise when growing a business, you’ll have a number of incomings and outgoings as well as payroll and reporting to manage. Cloud accounting software can help automate these processes, saving you time and a lot of hassle!

FreeAgent simplifies the bookkeeping process and automates most of the accounting leg-work meaning you’ll have more time to hunt for new clients and focus on running your business. But why might it be the right option for you?

What is FreeAgent?

During the research for this FreeAgent review, we found it’s an affordable and automated piece of online accounting software that is designed to help small businesses and freelancers manage their accounts and tax returns more efficiently, giving you more time to focus on running your business!

Why FreeAgent?

Hiring an accountant or bookkeeper to constantly manage your books can be a particularly large expense on your business, something that a lot of small enterprises cannot afford. Whilst FreeAgent prices are affordable and come with a host of features, we recommend that you compare accounting software based on your business needs.

Here are some of the FreeAgent features in greater detail.

FreeAgent Review: Features

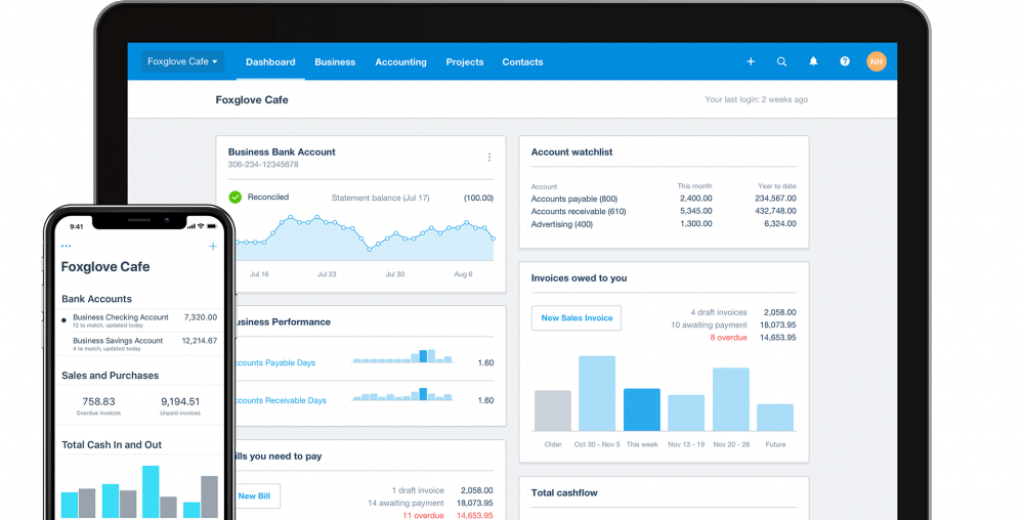

Automated Accounting

One of the best features is it’s slick and easy to understand bookkeeping dashboard, which connects easily to your business accounts and automatically tracks your incomings and outgoings. You’ll easily be able to see all of your businesses’ financial reports with detailed yet easy to comprehend profit and loss sheets and balance sheets.

If you’re working with an accountant, you can also give them access to your FreeAgent account to monitor your financial statements. Accounting software like FreeAgent, will also connect to most business bank accounts, enabling you to reconcile bank transactions.

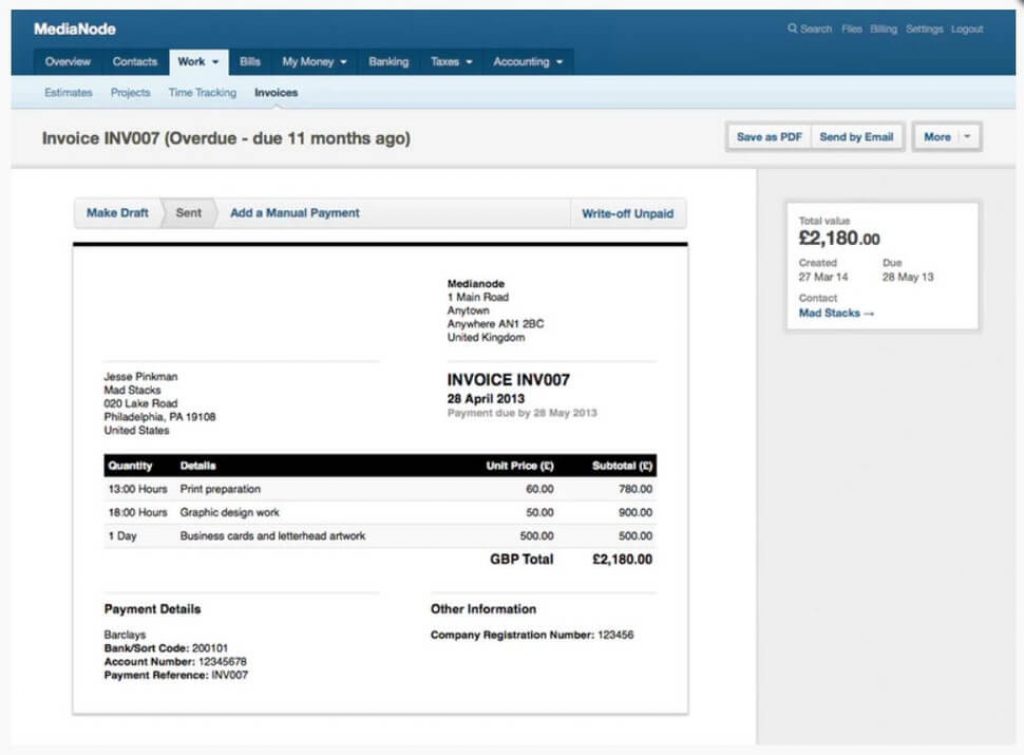

Estimates, Proposals & Invoices

FreeAgent enables you to create, send, and track professionally designed invoices using FreeAgent’s invoice templates. The software allows you to see who owes you what and what’s been paid in a real-time stats chart and we loved that you can view these stats while you’re on the go with the FreeAgent app.

We all hate chasing people for late payments as well. It’s a massive gripe of mine personally. But one of our favourite features is that it will automatically chase up those annoying late payments for you, so you can get paid faster.

Plus if you’re feeling super efficient you can also use the invoice automation tools to turn your estimates into invoices, once they’ve been accepted, at the click of a button.

Expenses

Grabbing a coffee on the go or are you out wining and dining clients? FreeAgent has you covered, tracking all of the business expenses you incur through its automated expenses features so your personal account is never out of pocket.

Hate fiddling with paper? Take photos of your train tickets and expense receipts using the FreeAgent mobile app and upload them from wherever you are. These will automatically be logged in your account, giving you an accurate picture of just how much you have spent.

Plus you can also keep an eye on your employee’s business expenses to help you track how much of your business outlay is going onto expenses. It’s worth considering that some digital business bank accounts have integrated income and expenses reports within the app.

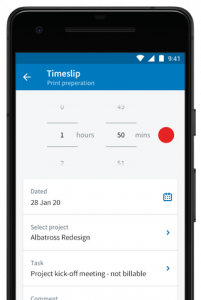

Time Tracking

Want to be more efficient? You can figure out how much your time is worth using FreeAgent’s time tracking tools, an efficient way to see how much time you’re billing, and always ensure you bill your clients the right amount.

You can then easily log this time in an invoice and send it off to your clients. Plus we loved that you can give your clients accurate time recording reports to see how you and your employees are progressing on the job.

Tax Features

Whether you’re self-employed, a small business or a larger corporation, you’ll feel confident and relaxed with FreeAgent managing your tax returns and VAT payments.

Filling in your HMRC Self Assessment can be an absolute nightmare if you don’t know what you’re doing. Instead of paying someone to do it for you, you can use FreeAgent to populate up to 90% of the Self Assessment form and file it directly to HMRC, helping you avoid those horrible surprise tax bills.

Plus you’ll also be able to take advantage of FreeAgent’s Tax Timeline feature, providing you updates of your tax calculation and upcoming tax deadlines. If you’re calculating your VAT returns, FreeAgent will automatically generate your tax return from your bookkeeping data and will file that online with HMRC in a few simple clicks.

We love how simple FreeAgent makes it to submit your VAT returns, while also keeping you constantly aware of how much and when you owe it through FreeAgent’s Tax Timeline. Plus if you’re a business, FreeAgent will also track a live projection of your corporation tax using your bookkeeping information.

FreeAgent’s Tax Timeline will also sync up to your business email such as Outlook, Google Calendar, or any other calendar, to notify you when your corporation tax deadline is.

Support

FreeAgent has a wealth of online support ready for you to use if you encounter any issues on the site. You can browse its FAQ’s and help topics or schedule a 20-minute call with one of their dedicated support teams if you need some better advice.

Although FreeAgent does not provide a 24/7 live chat, sometimes we think it’s better to talk your problems through on the phone with a service agent, rather than on live chat.

FreeAgent Review: Trustpilot

Many users online rank FreeAgent as one of the best online bookkeeping tools and 82% of its Trustpilot reviews give Excellent 5-star ratings with most reviews reporting a “fantastic user experience” as well as a “professional” and “supportive” customer service experience.

Although not every FreeAgent Review you’ll find is great, with some users reporting the software to be “expensive” and it being hard to contact support agents.

FreeAgent Review: Prices

With 50% off for your first 6 months, FreeAgent prices provide a great value for money service for the first 6 months. See how FreeAgent compares to other accounting software providers.

For all of their plans, you’ll get unlimited users, unlimited invoicing, and unlimited projects, you’ll also not be subject to any contract or setup fees. Plus if you pay your first 12 months upfront, you’ll get 12 months for the price of 5! FreeAgent split their pricing plans into your business needs offering a £9.50 per month plan for Sole Traders, which includes self-assessment filing.

The next tier up is the partnerships/LLP plan costing £12 per month plan for partnerships/LLP’s which includes a profit share calculation feature and a £14.50 per month plan for limited companies which includes self-assessment tax filing, dividend vouchers, and corporation tax forecasting.

FreeAgent prices are fairly cheap for the first 6 months, but they double in price, with the sole trader option hiking to £19 per month, which is a fairly expensive outlay for a small business or sole trader.

You will get a lot of good features included in this price though, and it is certainly worth paying that bit extra to have a trustworthy bookkeeper to keep your tax accounts up to date.

But how does FreeAgent match up against other online bookkeepers?

FreeAgent vs Xero

FreeAgent provides a great bookkeeping solution to help you manage your accounts but Xero might provide you with a better value for money service if you’re a small business.

FreeAgent vs Xero Prices

It’s tough to compare each of FreeAgent’s plans to Xero’s. FreeAgent tailor their plans specifically for the needs of each kind of business, whether that’s a limited company or a sole-trader.

Meanwhile, Xero’s plans are structured by the number of features and services included in each plan. This is why FreeAgent might provide a better value for money service, as it allows you to pick a plan that includes a suite of features that are tailored to the needs of your business.

This means you won’t end up paying for any additional extras that you don’t need. Xero’s basic plan, coming in at £10 per month, is also extremely restrictive and overpriced. It only allows you to send out 5 invoices, 5 estimates and reconcile only 20 bank transactions.

For almost the same price, at £9.50 per month, you can create unlimited invoices and quotes through FreeAgent’s Self-Employed plan. Plus it seems FreeAgent offer the best deals, as although Xero give new subscribers a 30-day free trial, FreeAgent do the same but go one step beyond offering new customers, a further 50% price reduction for their first 6 months membership.

Ultimately you get a better value for money service with FreeAgent through its tailored packages and its discounted business plans.

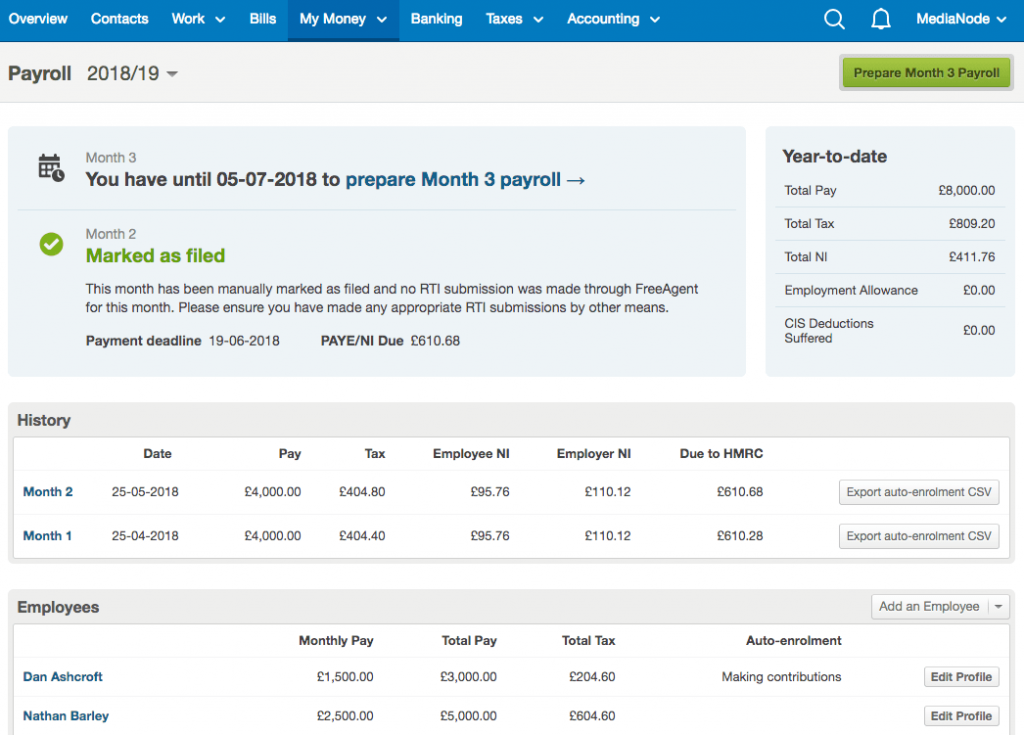

Payroll Add-Ons

One of the great features of FreeAgent’s payroll calculator is its compliance and vetting by HMRC. It will automatically calculate and run your monthly payroll while filing national insurance and PAYE contributions for you as part of its packages.

Xero offers a very similar set of payroll features to FreeAgent, but you’ll have to pay an extra £5 per month for it, a definite markdown for Xero.

FreeAgent vs Xero Features

Xero edges it here on usability. The system has a ton more features and its eye-catching design and dashboard make it a better option than FreeAgent if you’re looking for something easy to use with presentable financial analytics.

One cool feature FreeAgent lacks is an accurate mileage tracking application. Xero again nudges past FreeAgent here with its mileage tracking system powered by its application.

You can use it when you set off on your journey, using your smartphone’s GPS systems to accurately calculate how many miles you have traveled and then how much fuel you have used. This is definitely a better option than faffing around with petrol station receipts.

Plus if you currently have all your accounts on Excel, you can easily transfer them into Xero more efficiently than FreeAgent.

Ease of Set-up & Project Tracking

When it comes to tracking what’s going on in your business, FreeAgent has a simple project and expense tracking system which can help you manage your time and efficiency a lot better.

Xero does not have these project tracking features, meaning that if you opt to use Xero you’ll have to manage your projects yourself.

FreeAgent vs Xero Verdict

It comes down to your business requirements and what you’re looking to spend on your bookkeeping software. It’s simple and does everything you need at a great price. It also offers a specific package for sole-traders which Xero does not.

Xero is more suitable for larger and growing businesses and has a wider variety of features, some being fairly intricate to use and are better suited to a larger business. We recommend considering Sage as an accounting software for large business. Check our our review of Sage.

FreeAgent vs QuickBooks

FreeAgent vs Quickbooks Prices

QuickBooks and FreeAgent offer very similar features and are both specifically tailored for small businesses and sole traders. But pricing wise QuickBooks is definitely a cheaper option than FreeAgent on all of its pricing packages and is way easier to understand.

For example, instead of pricing by the type of business you are running, as FreeAgent does, QuickBooks separates its prices by how big your business is and what it’s requirements are. And with its self-employed plan being nearly half the price of FreeAgent’s sole trader plan at £4 per month, it is the better value for money service looking at the features QuickBooks throw in for that price.

Payroll Add-Ons

Quickbooks’ Payroll features are very similar to FreeAgent’s software in sorting payslips, pensions, and tax deductions for you. But FreeAgent wins here, as with QuickBooks you’ll have to purchase an extra package costing either £4 or £8 per month on top of your subscription.

With FreeAgent you get its payroll functions included in the price of its packages.

FreeAgent vs Quickbooks Features

QuickBooks has better functionality, and like Xero, it has a dedicated GPS mileage tracker meaning you can accurately and easily record all your fuel costs. Plus QuickBooks has multiple mobile applications, one for standard business accounts and one for sole traders tailored to help them submit their tax self-assessments.

FreeAgent only has one app that doesn’t have the best functionality or layout compared to QuickBook’s slick applications. But when it comes to time recording, FreeAgent’s time recording tools come included in its packages while QuickBooks requires you to purchase an additional time tracking tool from $8USD per month.

Although this expense is a little annoying, if you need a really comprehensive time tracking tool this QuickBook’s time recording software is far more comprehensive, offering greater features than FreeAgents time tracking tools.

Support

We think QuickBooks is best for support, mostly because it offers 24/7 live chat. You never know when you’re going to need help and problems can arise even in the middle of the night! But Quickbooks also has a vast library of helpful material online.

It has a blog dedicated to helping small businesses get through the current Coronavirus crisis plus more helpful tips and information on how to best manage your income and how to pay your tax.

FreeAgent does have a huge amount of resources available, including a UK call centre, but its support network is just not as developed as QuickBooks’ and having to book a call to discuss a problem might not be the fastest way to solve your issue.

FreeAgent vs Quickbooks Verdict

It is hard to split QuickBooks and FreeAgent. Both are tailored to smaller businesses and sole traders and while QuickBooks has more features, it lets itself down because of the upselling it does to get you to purchase add-ons like its payroll features.

These features come included in the FreeAgent package prices, making FreeAgent perhaps a better value for money service although QuickBooks is the cheaper service.

But in terms of usability, features that are included in the base price, and its functionality, QuickBooks is our preferred choice, simply because it’s apps are easy to use, and it’s clearer to see your profit and loss statements on its dashboard.

For its base prices, QuickBooks is our preferred choice.

Check out our QuickBooks review.

FreeAgent Review: Conclusion

Bookkeeping can be complicated, detailed, and quite frankly time-consuming. Having a platform that manages and looks after all your costs, earnings, and expenses in one place makes it a lot easier to run your business.

FreeAgent is a great option enabling you to automate all of your finances, while also keeping you notified of when you need to pay your bills or taxes to HMRC.

Although it is slightly pricier than other platforms, it is a great option for small businesses and can secure you a reliable and quality service that is simple, yet performs a wealth of functions for you, enabling you to continue to focus on running your business!

If this FreeAgent review has helped you please recommend DigitalSupermarket. Compare digital bank accounts for your business.