Can’t decide on the best accounting software for your business? In this Quickbooks review UK, we’ll help you decide if it’s the best choice for your business.

In this review…

- What is Quickbooks?

- Quickbooks review: Features

- Quickbooks pricing

- Quickbooks for self-employed

- Additional services

- Quickbooks support

- Quickbooks vs Xero

- Quickbooks review: Conclusion

- Still deciding?

What is QuickBooks?

Pay your bills, track your invoices, and manage your time all through one platform. This is efficiency in a nutshell, right? Well if you’re looking for a value for money bookkeeping service, look no further.

QuickBooks provides you with a fast and simple way to run your business accounts from anywhere in the world. If you’re setting up a new business, choosing an accounting software is one of the first things you’ll need to do.

Cloud accounting software will integrate with your business bank account to reconcile payments and automatically create reports.

This Quickbooks review UK will show you exactly why it’s worth considering.

Using its cloud accounting software, QuickBooks enables small and medium-sized businesses to keep track of their income and expenses. It comes with a range of scalable and affordable packages, meaning that as your business grows, QuickBooks can facilitate that growth by tailoring its service to meet the needs of your business.

Plus, QuickBooks has not forgotten about those who are self-employed, offering a tailored plan for to help sole traders keep a track of tax estimates and file their HMRC Self Assessment at the end of the financial year.

Depending on the size and income of your business, we recommend using QuickBooks over other online bookkeepers as it offers the best suite of features for the best value for money.

Although it does upsell on some features like its payroll and time tracking features, as you’re business starts to grow bigger, you will start to value the functionality and efficiency of having all your accounts in one place on QuickBooks’ platform.

Checkout the latest Quickbooks deals.

Quickbooks Review: Features

You can easily get lost in QuickBooks’ myriad of features. Here’s the top 8 features that you’ll find most useful:

Manage Sales & Income

After connecting your business accounts to QuickBooks, its software will automatically track and log all of your incomings and outgoings, meaning you won’t constantly have to punch numbers into an excel spreadsheet.

Plus the bookkeeping software will keep on top of any outstanding bills and notify you when they need to be paid.

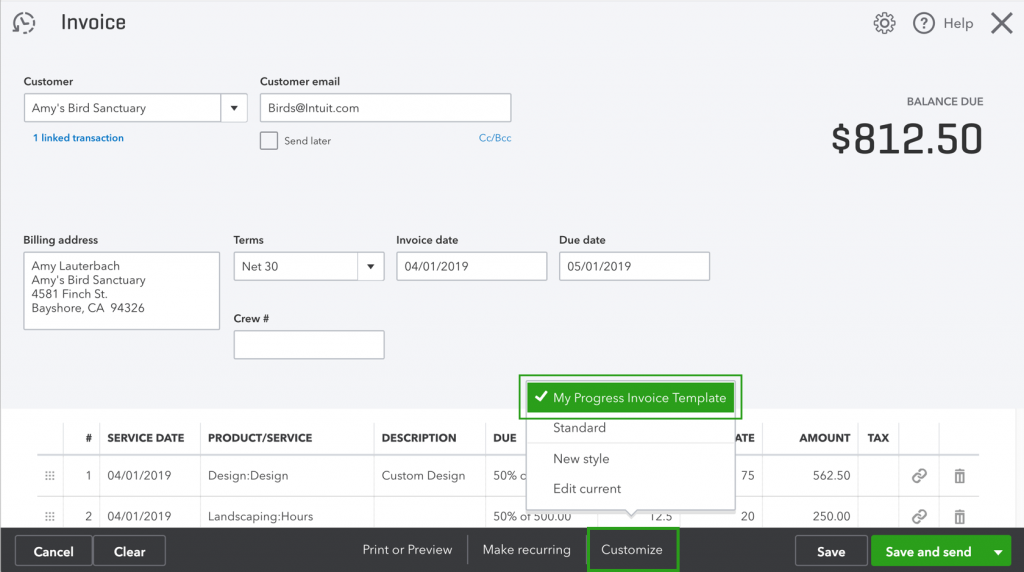

Smart Invoicing

We know how much of a drag it can sometimes be to send and keep a track of all your invoices. This is why we loved QuickBooks’ smart invoicing feature, enabling you to keep money coming into your accounts from anywhere you are in the world.

You can quickly set up and send out professional estimates and invoices from your laptop, phone or tablet and QuickBooks will automatically track what payments are outstanding and which have been paid in half or in full.

Plus it comes with another neat feature you can use when sending out estimates. If your client accepts a quote provided them, you can utilize QuickBooks’ smart invoicing features to turn those estimates into an invoice at the click of a button, meaning you get paid faster.

Plus the app also has a recurring invoice feature, great for those working on continual projects!

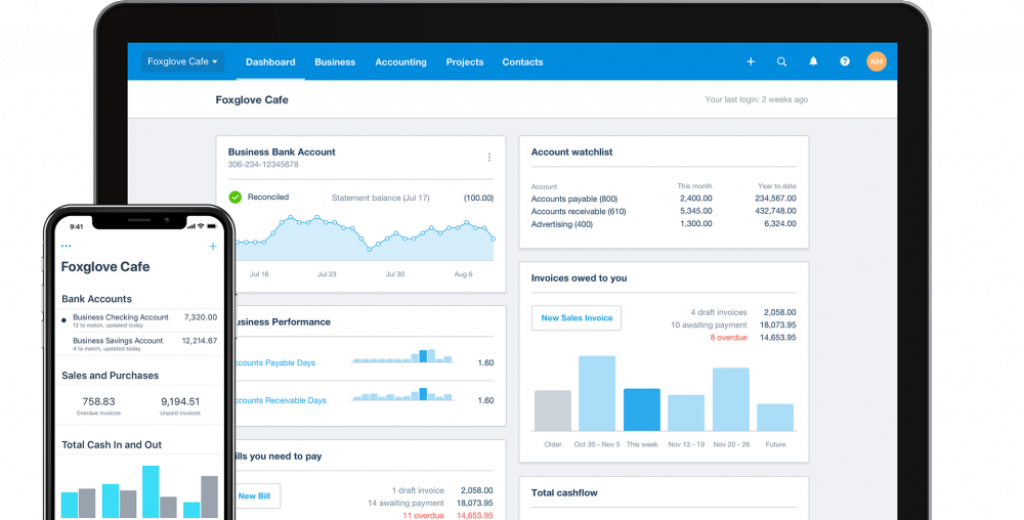

Work Smarter With Business Insights

It is imperative for any business to keep track of their cash-flow. We liked the way Quickbooks presents your finances, in one user friendly and easy to navigate dashboard. Here your profit and loss, tax expenses, and sales statistics are all laid out in an easy to read and eye-catching data chart.

We found it easy to understand and keep track of how our business was doing. From here you can also run more detailed reports, on your balance sheet or cash flows, to gain better insights into how your finances are doing.

We also loved their 90-day liquidity forecaster which takes into account your bills, outstanding invoices, and tax considerations and gives you an idea of what your cash flow will look like over the next 3 months.

This is a great feature for small businesses as it can give you comfort knowing what you can expect to earn in the coming months.

Manage Your Tax

Tax, everyone groans when they hear this word. But don’t worry, QuickBooks has a variety of features that will take the pain out of managing your tax accounts. With QuickBooks you can easily prepare, submit, and track your VAT, to remain compliant with HMRC’s Making Tax Digital Regulations.

Unlike other online bookkeepers, QuickBooks also has an automated SmartScan feature that will review your accounts and notify you of any tax mistakes, for example, if a transaction does not have the right VAT code. QuickBooks also uses a data extraction system, analyzing payments going into and out of your accounts and calculate your VAT on that basis.

This is a great automated feature that saves you from having to input figures yourself, saving you time, preventing typos from appearing, and making your tax payments faster and more accurate.

Plus for those who aren’t registered for VAT, Quickbooks also helps sole traders submit their HMRC Self Assessment, crunching the numbers for you so you won’t get caught out down the line with an unexpected tax bill. One of the main bonuses of QuickBooks is how seamless it makes your tax payments, keeping you constantly updated on how much you owe.

Track Your Expenses

QuickBooks is changing the accounting game by fully automating their software. You no longer need to punch in your expenses and costs into an excel spreadsheet, but can rely on QuickBooks to extract data from your bank accounts and categorize it into expenses folders for you.

Having everything in one place, plus using these automatic accounting tools ultimately makes managing your expenses more accurate and can save you heaps of time.

Mileage Tracker & Receipt Scanner

Sometimes it can be difficult to record how much you’re spending on your expenses. But again QuickBooks has found an easy way for you to record your fees through their mileage tracking and receipt scanning tools.

Using the mileage tracking feature on QuickBooks’ mobile app, you can quickly calculate how much fuel you have used traveling from A to B, and how much you are owed in return from this. Plus you can also scan in any receipt to the app meaning you will never be scared of losing any paperwork again.

Once the information has been scanned, QuickBooks will then record these expenses in your dashboard so you can quickly see how much you’re spending and where!

Account For Your Time

One of the great features about QuickBooks is that its functionality allows you to do everything and keep a track of it all in one place. Having your time tracking software linked to your accounting systems is also a big bonus in helping you analyze how much time you spend on a job against the cost of that job.

Although it does come at an additional price, QuickBooks’ time tracking software, TSheets, can help you record your time and manage your projects, to help you become more profitable and meet your deadlines.

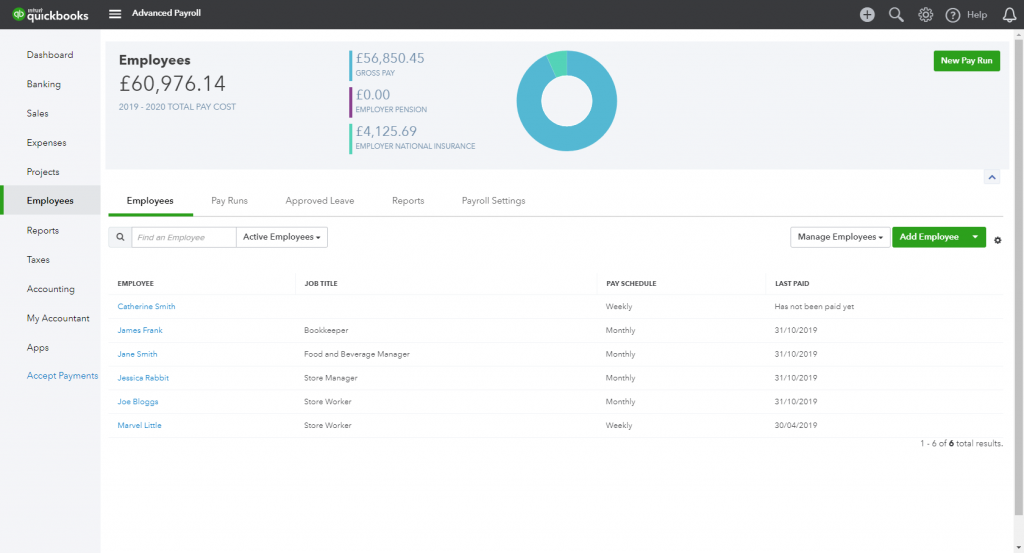

Run Payroll Fast

QuickBooks’ payroll programs can accurately help you accurately stay on top of your employee outgoings. Although the plans come at an additional cost, we think this is a value for money option.

QuickBooks payroll will link up seamlessly with your other plans, incorporating your payroll figures into your other financial statements, making it easier for you to see all of your incomings and outgoings in one place.

With the Payroll feature, Quickbooks will quickly work out and pay your employees their salary, any overtime due, and will deduct pensions and tax from their overall payslips.

What’s more is this system is all compliant with HMRC, and you’re covered by QuickBooks’ 24/7 support, allowing you to not worry about the admin side of your company and focus on growing your business.

If you’re looking for other payroll services, you may also want to consider Sage and FreeAgent.

QuickBooks Pricing

QuickBooks has 4 base accounting plans tailored for small to medium-sized businesses and sole traders. When picking your plan, make sure you read the fine print, as currently, QuickBooks are offering 60% off each plan for the first 6 months.

After that each plan doubles in price, so make sure you double-check the continual rates of your preferred plan after you’ve seen their sign-on price.

Check the latest prices.

Business Planning

Depending on the size of you’re business, QuickBooks’ plans offer access to the majority of the features listed above, including its innovative SmartScan service, Cash Flow Planner, and its mileage tracker.

For small-start ups, we recommend opting for the Simple Start package as it contains all the basic features you’ll need from your online bookkeeper, at an affordable starting price of £6.00 per month.

But what’s great about QuickBooks is that its plans are totally scaleable, so as soon as you see your business start to grow, or if it is already operating at quite a high rate, you may want to opt for the £10.00 per month or even £15.00 per month services. These plans will give you more user accessibility, support for multiple currencies, and project profitability tracking.

We have simplified below what you get included in each plan.

QuickBooks For Self-Employed

QuickBooks also takes into consideration the needs of those who are self-employed, providing sole traders with an extremely good value for money service at £4.00 per month. Although one negative about this plan is that you cannot upgrade this plan if your business takes off massively.

Despite this, the self-employed plan is still a great option for sole traders and gives you access to the QuickBook’s expenses tracking software, income and accounts software, and helps you file your HMRC Self Assessments each year.

Additional Services

QuickBooks are guilty of upselling for some of their additional services. For example, if you want to add payroll features on to your package, expect to pay an additional £4.00 per month as a minimum.

And what about time recording? Well to gain access to QuickBooks’ TSheet packages, expect to pay around an additional £6.00 per month.

Added costs can be annoying, but for ease and efficiency, it may be worth adding these features, so you can connect all your payroll costs up to your QuickBooks dashboard, giving you a more accurate overview of all your finances.

| Starting price | Price after 6 months | Features | |

| Simple | £6.00 | £12.00 | 24/7 support, tax management software, SmartScan VAT error checker, unlimited invoicing, multiple bank card connections, income and expense management, mileage tracking, financial reporting, 1 user only. |

| Essentials | £10.00 | £20.00 | Simple features, plus added bills and payment management, multiple currency support, up-to 3 users. |

| Plus | £15.00 | £30.00 | Essentials features, plus stock management, employee time tracking, project profitability tracking, budgeting, and up-to 5 users. |

| Self-Employed | £4.00 | £8.00 | HMRC Self Assessment, Income tax estimates, income and expense management, mileage tracking, finance reporting, unlimited invoicing. |

Quickbooks Support

One of the best features about QuickBooks is the vast array of online material it has available to its users. If you’re new to the game and are worried about, for example, how best to make VAT submissions, you can check out their help and support pages which has a host of answers, forums, and guides on many different business management queries.

If you’re still stuck, you can contact the QuickBooks support team via phone or via their 24/7 live chat. Unfortunately, their phone lines are only open during normal business hours, but once you do contact the advisors, you’ll be met with knowledgeable and trustworthy representatives who will quickly help you resolve your issues.

Plus, QuickBooks are also providing their customers with access to a range of business advice and resources to help you recover your business since the COVID-19 pandemic. They really are going the extra mile to support their customers during this time of uncertainty.

It seems we weren’t the only people happy with QuickBooks’ customer support. The Quickbooks review ratings on Trustpilot show users reported support agents to be “helpful”, “polite” and “professional.”

QuickBooks vs Xero: How Does It Match Up With Its Competitors?

Compare all Accounting Software.

Xero, one of QuickBooks’ main competitors, providing a very similar more streamlined accounting software for small to medium-sized businesses. It is hard to separate the two on features alone, but depending on what your business needs are, you may find one to be better suited than the other.

Quickbooks vs Xero Cost

Comparing QuickBooks’ Simple plan to Xero’s starter plan, you’ll see that with QuickBooks you’ll get access to heaps more services than what Xero’s offering. And for £10.00 per month, Xero will only let you send 5 invoices out as opposed to QuickBooks’ unlimited invoicing allowance across all its plans.

Plus Xero does not cater specifically for sole traders like QuickBooks’ Self-Employed plan, forcing sole traders to purchase one of their standard plans which are quite expensive for a sole trader.

Payroll Add-Ons

Both bookkeepers are guilty of upselling on their payroll plans, but who’s upsell is the cheapest? Well, Xero seems to offer a better deal, offering you their payroll package for free for 3 months, and follows on with a £5.00 per month fee.

Although QuickBooks’ fees range from £4.00 to £8.00, you’ll get Xero’s full package for just £5.00, which might be the more worthwhile package if you’re employing multiple staff.

Quickbooks vs Xero Features

It’s hard to separate the two based on their features. But we found it slightly easier to use QuickBooks. For example, it was a lot easier to connect a bank account to the application than it was on Xero, where payments also took slightly longer to be recorded.

Plus, unlike Xero, QuickBooks also has its own app specifically tailored for those who are self-employed meaning their account management process much more streamlined.

User Interface

Xero definitely edges QuickBooks through its smarter, modern, and more customizable dashboards. QuickBooks’ interface is also sometimes hard to navigate, while Xero is perfectly well set out and can be used by most people who aren’t very tech-savvy.

Ease of Set-Up

Xero also nudges past QuickBooks as it enables users to easily import Excel spreadsheets, something you cannot do on QuickBooks. Xero’s software makes it easy to upload your current figures and statistics in one go, meaning you can get up and running on this platform a lot faster than you can on QuickBooks.

Quickbooks vs Xero: Verdict

Ultimately it comes down to your business requirements. For medium to large sized businesses, you may find Xero the more comprehensive platform to cater to your needs.

But for sole traders and smaller businesses, we would advise you to use Quickbooks as it is the more affordable, better value for money option, with a suite of great accounting tools that can provide you with a truly professional bookkeeping service.

Quickbooks Review: Conclusion

As you’ve seen from our Quickbooks review, for an affordable price, Quickbooks’ huge array of features can help you save a great deal of time and money, enabling you to carry on growing your business while it takes care of all the complex number crunching for you.

Despite a couple of minor issues in terms of its pricing and user interface, having all your accounts, tax, payroll, and expenses in one easy to access dashboard is why we think QuickBooks is perfect for any sole trader or small business just starting up.

Visit Quickbooks for the latest offers.

Still Deciding?

Compare the best accounting software or choose a business bank account.

Did this Quickbooks review UK help you? If so please recommend DigitalSupermarket.