Sage is one of the most popular software tools on the market for bookkeeping, accounting, tax management and more. But is it right for you? This Sage review will help you decide.

Compare all cloud accounting software using our free tool.

In this Sage review…

- What does Sage accounting do?

- Sage review: Features

- Sage review: Payroll

- Sage employee benefits

- Sage review FAQs

- Is Sage any good?

- How much does Sage cost per year?

- Is Sage software easy to use?

- Sage customer support

- Still deciding?

What does Sage accounting do?

There are a number of important features Sage can offer your business. Its basic goal is to help you manage your business’ income and expenses through double-entry bookkeeping.

Cheeck out the latest offers from Sage.

In order to support this, it can manage lists of your connected bank accounts, as well as the accounts of your clients and customers for automated, customisable invoices. It’s possible to dynamically link banks to Sage through your sort code, account number, IBAN or BIC.

But you can also manually upload account statements if you don’t feel comfortable giving Sage access to your bank accounts – a nice bit of flexibility. The other big aspect to Sage is that for U.K. business owners, it can automatically calculate and submit your VAT returns to HMRC, meaning you don’t have to work out the right returns by yourself.

In general, Sage saves business owners a lot of time and frustration in trying to figure out the intricacies of accounting for themselves. Instead, it lets them focus on running and growing your business.

Sage Review: Features

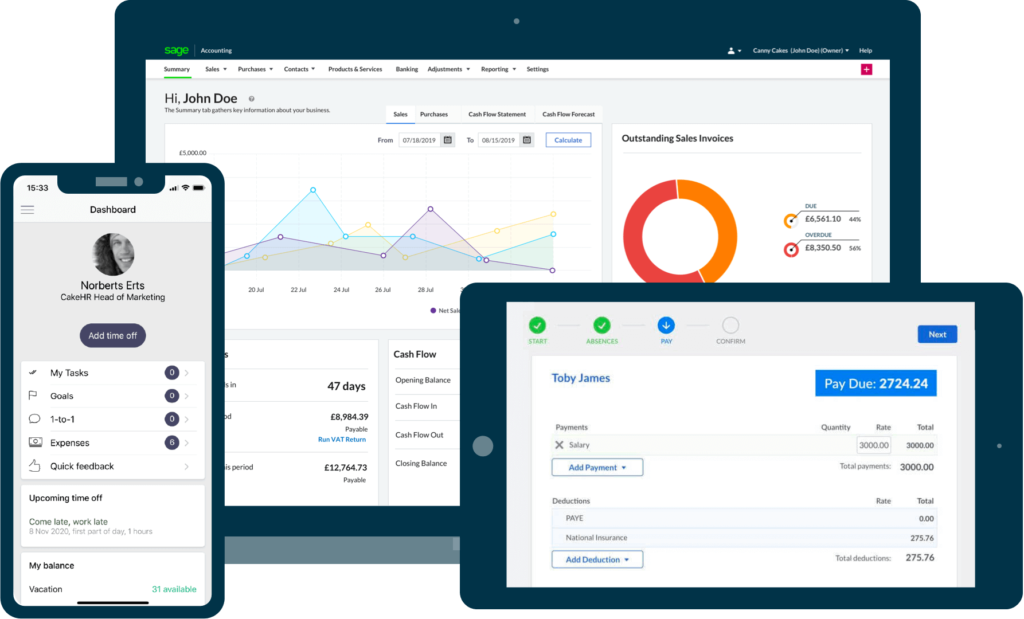

Sage is a suite of accounting software that lets you automate your bookkeeping. It’s cloud-based, meaning that you can access it from anywhere, like you would any normal website. This means you’re never far away from your company’s finances.

What really sets it apart from the competition is that it’s been officially recognised by HMRC, meaning it’s qualified to help you file your tax returns. This feature alone can save you dozens of hours every month when it comes to working out the right VAT you have to pay.

Sage Review: Payroll

Managing payrolls is one of the most frustrating and annoying parts of doing the accounting for a business. It’s finicky work where you have to juggle an employee’s hours worked, their wages, any benefits they’re due and what banking details they have linked up.

Sage’s accounting software offers numerous ways to streamline this process and let you run your payroll accurately, easily and securely.

4-Step Pay Run

The reason why Sage’s payroll software is so useful is that it’s been designed from the ground up to be quick and simple to use – no mean feat, when you consider that it has to calculate taxes! With Sage, once all your employees and corporate information is set up, you can run through your payroll in an easy four-step process.

You just have to enter the employee information such as hourly pay or salaries, and Sage will do the rest of the heavy lifting for you.

Sage Payslips

This trend of making complicated topics easy to use and understand continues with Sage’s approach to payslips. Their payroll software is a joy to use, and the payslips it generates are all very clearly-presented, even if you’re not good with technology or familiar with accounting practices.

It lets you print or email payslips online, as well as P60 slips and even simple payroll reports for your business ledgers.

Instant HMRC Submissions

Because Sage is officially recognised by HMRC, it’s qualified to submit payment and tax returns to them in real-time. What used to take hours of agonising calculations can now be done in a single click using Sage Payroll.

To get more specific, Sage can help calculate what you need to pay in terms of VAT, PAYE and National Insurance contributions. This streamlines the normal operations of your business by an incredible amount, freeing up time you can use to to advance your career.

Workplace Pensions

In case you weren’t aware, as an employer in the UK you’re obligated to enroll your employees in a pension scheme of some kind, and can face fines if you don’t do so. Sage makes this process much easier by offering functionality that lets you automatically assess and enroll your employees into a workplace pension of your choosing as an integrated part of the 4-step payroll procedure.

You can set up multiple pension schemes for your company for different classes of employee. The main information you need to use Sage’s pension module effectively is:

- Your staging date

- What users can access the pensions data

- What payments to your workers are classed as qualifying earnings

- The introduction letter your staff will receive on enrollment

Using Sage’s pension module is a great way to automate pension plan payments and ensure you follow all of your company’s relevant regulations and obligations.

Sage Employee Benefits

By this point, you might be getting ready to hand Sage your money. But what if they offered to give you money, instead? As wild as it sounds, the Sage Employee Benefits programme essentially does just that.

It’s offered for free to Sage customers for their first six months with the service, and helps small business owners offer perks to their employees that are usually reserved for massive corporations.

Some of these benefits include:

- OnDemand GP

- 24/hr Employee Assistance Service

- Employee Reward & Recognition

- Cycle To Work Schemes

- Holiday Deals

One of the most impressive benefits, which deserves some extra explanation, are the retailer discounts it makes available for your employees. With them, they can save up to £1000 per year at retailers like Starbucks, Currys PC World, Topshop, M&S, John Lewis and more.

Sage Review FAQs

Is Sage any good?

Sage is one of the most popular and well-respected accounting software packages on the market. It’s extremely full-featured, polished and effective at what it sets out to do.

This is reflected in the positive reviews it’s received from customers. On Trustpilot, for example, it has a 4.8/5 rating from nearly 13,000 total reviews.

Here’s a sample of a typical review:

“Fantastic service. Within one week an ad hoc report was produced to help our business manage the debtors in these trying times. Very pleased with the service received from Sage. It was excellent!“

Other common points of praise include their excellent customer service, which regularly helps people with difficult or complex technical problems within a day.

How much does Sage cost per year?

Sage costs between around £120 to £300 a year, depending on what tier you decide to use. It works off of a monthly subscription model, split into 3 tiers:

- Start

- Standard

- Plus

The regular monthly cost for these tiers, respectively, is $12, $24 and $30. Some of the extra features only available in more advanced plans include being able to forecast your cash flow, manage your product inventory, any ePOS transactions you’ve had, customer cash and card payments and send quotes or estimates to potential clients.

Is Sage business cloud accounting the same as Sage one?

Yes, Sage Business Cloud Accounting is the same as Sage One. Sage renamed the product to Business Cloud Accounting to unify their product line, and because ‘Sage One’ did little to explain the actual purpose of the software.

Is Sage software easy to use?

Using Sage is definitely a lot easier than doing all your bookkeeping by hand. It automates a lot of the trivial tasks and lets you focus on the big-picture of accounting more easily.

In order to do that, though, it has to contain a lot of fairly complex functionality. While Sage’s interface is intuitive and easy to understand, it takes time to understand all of the things it can do.

One thing to note for newcomers is that Sage is based off of the double-entry bookkeeping model, which is often difficult to understand for people not used to it.

Sage can help you manage your business credit card bills, stock inventory, small business rates and invoices, and reconcile your bank transactions.

Sage Customer Support

Sage is well-regarded for their customer support, which offers 24/7 help over email and phone lines based in the UK. You can also get in touch at any time using the live webchat on their website.

Their website also offers hundreds of pages of guides, advice and FAQs that make it easy to find answers for almost any problem you might run into while using the program.

Check out the latest offers from Sage.

Still deciding?

This review has outlined some of the major features of Sage and explained how it can be useful for small businesses in automating their bookkeeping, payrolls and taxes. Compare all accounting software. You can also check out our reviews of Quickbooks, Xero and FreeAgent, two other popular accounting software.

Did this Sage review help you? If so please recommend DigitalSupermarket.