Osome is an advanced and flexible accounting service that provides entrepreneurs, businesses, and freelancers with end-to-end assistance with a range of financial and regulatory issues. It is so much more than an accountancy firm combining smart technology with expert financial minds. In this Osome review, we look at what the company really has to offer and what impact it could have on your business.

In this Osome review…

About Osome

Although relatively unknown in the digital accounting industry, Osome has built a solid and respectable reputation elsewhere. It is targeted predominantly at SMEs, freelancers, and traders, particularly those that work in e-commerce.

One of the brand’s specialities that set it apart from similar services available to UK businesses is the assistance with organising compliant and efficient EU trading deals- and the tax that goes with them.

Osome Pros and Cons

Pros

- Certified accountants

- Variety of services for different size businesses

- £100 discount on yearly subscriptions

- UK & EU trading support

Cons

- Comparatively expensive plans

- Not suitable for larger businesses

Pros

All the accountants associated with Osome are fully qualified UK-based accountants with immaculate reputations and records. They provide a hands-off service to help businesses manage their finances as efficiently as possible.

The packages offered by Osome are far from one size fits all because not all businesses have the same set of requirements. Each plan includes some core features that benefit everybody, but the extras vary to match a variety of needs. This flexibility is one of the best things about Osome as a service.

Every new user can take advantage of a £100 discount when they first set up an account, regardless of what package they choose. This not only makes the subscriptions more affordable, but it also helps give businesses that are starting out an extra boost to get started.

Many aspects of UK business became infinitely more complicated in early 2020 after Brexit, leaving SMEs across the country to face a whole new set of regulations and VAT confusions.

Osome helps businesses to navigate these newly turbulent waters, providing advice and insight regarding the current laws. The company can also assist with EU tax filing and reporting for UK-based businesses that sell products in Europe.

Cons

Overall, the fees charged by Osome are a little bit higher than some of the competition, although the reliable service provided seems to justify this fact. That said, many paid extras are not included in any plan but may be essential to some businesses. At least there is a free demo you can try before you buy.

Although Osome is an excellent solution for SMEs, it lacks certain features that many large-scale businesses may require. Companies with complex accounting needs should consider a more specialised service.

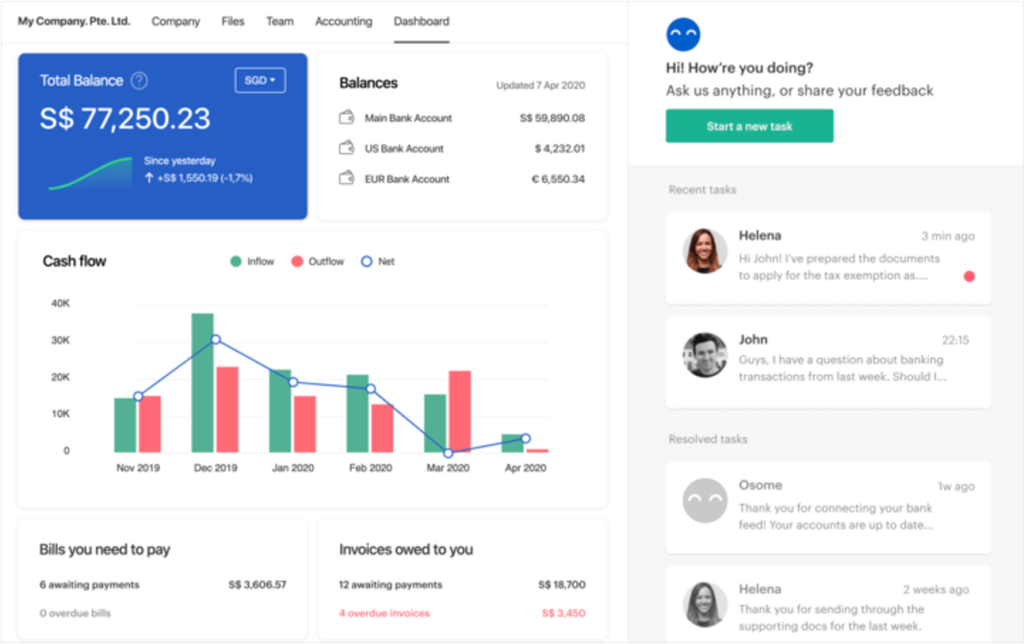

Osome Features

Accounting

Osome’s accounting service is extremely impressive and comprehensive. There is really nothing they cannot do for you. There are different plans designed to work for ecommerce businesses specifically, then a variety of other services for general accounting. The service quality is excellent, but there are a lot of extra costs.

ECommerce Accounting

As we mentioned already, Osome has features that are tailored specifically to ecommerce companies. Some of the ins and outs are similar, but there are big differences, which is what makes this feature helpful for newbies.

Bookkeeping

Bookkeeping is just one of those things that every business needs to do that very few people ever look forward to. Having a dedicated service to take care of every possible aspect of bookkeeping so that you can focus on growing the company that you love is too good an idea to resist.

UK – EU Trading

Osome has guides and training plans in place to advise UK businesses (ecommerce in particular) that want to continue trading in Europe after Brexit how best to do it. The associated accountants and advisors not only provide the information, but they also assist in filling out all the documentation and making it happen.

Company Registration & Setup

Launching a company involved a lot of admin, especially if you want to get started on the right foot. Osome has a business launching feature that offers services tailored to brand new companies ready to fly.

Osome Prices and Plans

Osome offers three paid plans, each offering a very different combination of services. You can also apply for access to a free demo to get an overview of how things work with the various features before you commit to a subscription.

The pricing can get a little confusing, mainly because of how many different services are offered. Because of this, it is best for interested parties to do some thorough research into the pricing to find out what plan is right for them or to speak directly to a representative.

Here is an overview of some of the available prices and plans. Please note that all prices quoted exclude VAT.

Mini Yearly Accounting Plan (£45 per month)

Aimed at independent sole traders – such as Shopify store owners – the mini yearly accountant plan is Osome’s entry-level paid tariff. It offers basic accounting services with a professional edge and is more than enough for an individual or enterprise that operates on a small scale. It includes:

- An appointed accountant and personal bookkeeper

- Yearly management reports for all aspects of your business

- Statement filing and confirmation

- CT600 corporate tax return

Someone who does not yet have an accountant to look after their finances could find this plan extremely helpful, especially since all the involved accountants are experts in their fields. There is only a limited selection of extra features, but not everyone is interested in the extra frills.

Bookkeeping Plan (£99 per month)

Maybe you already have a business accountant, but Osome can still help. The middle tier plan targets small businesses or enterprises that need to level up their bookkeeping and financial organisation across the board.

With this plan, you gain access to a personal booker who updates your figures daily, as well as ensuring your records are perfectly prepared for your accountant whenever you need them. Other features include:

- Possibility to integrate your bookkeeping with one platform, including Amazon or Shopify (ideal for small ecommerce companies)

- Online training sessions on effective bookkeeping for a successful business

- Platform fees separation

This package serves a very different purpose to the mini-plan, which is why people should put in the research before settling on what, if any, Osome plan to choose.

Monthly All-In Accounting Plan (£120 per month)

Alternatively, they can just pick option three and get the best of both worlds. The All-In Osome plan is exactly what it says on the tin: access all areas accounting and bookkeeping services with a difference. It includes all the features included in the first two plans plus a few more:

- Monthly reports as well as annual reports

- An appointed personal accountant with expert knowledge

- Corporation tax filing

- Statement filing

- VAT advice

£120 every month may seem steep, but it is well worth it when you consider how much you get for that price. However, many services cost extra, even on this plan. You could end up paying much more than this some months if you have additional requirements such as foreign VAT filing or multi-currency trading.

Launch Me / Establish Me Plan (£100 one-off payment)

Another service Osome offers is helping new businesses get set up with all the correct financial documentation and essential paperwork to start operating. Osome also helps determine what, if any, tax credits or reliefs an SME is entitled to and helps them to apply.

There are two very similar plans, both for £100.

General Accounting (between £100 and £400 per month)

The Osome accounting solution is available on four price tiers. All levels include exactly the same features but have different limits on how many monthly transactions are allowed. All plans offer:

- A subscription to Xero accounting and the services that come with it

- Daily bookkeeping services

- House filing for business

- Tax returns

- Monthly management reports (excluding the starter plan, which provides quarterly reports instead)

More extensive bookkeeping plans are available to add on in the four categories of Starter, Booming, Rocking, and Unicorn. Those prices range from £50 to £300, depending on the transactions and additional services.

Osome Review Summary

Osome is not the cheapest option for businesses looking for an intelligent accounting or bookkeeping solution, but it does offer a comprehensive and impressive service. The variation in the plans available can be confusing at first, but it is actually a great benefit.

Entrepreneurs and SMEs that want to focus on building their company and need so assistance running the financial side of things can certainly find everything they need with an Osome subscription and then some- as long as they find it affordable.

If this Osome review helped you, please recommend DigitalSupermarket.