Find & Compare

Cloud Accounting Software

Find cloud accounting software, compare prices & features to get a great deal.

What is Cloud Accounting Software?

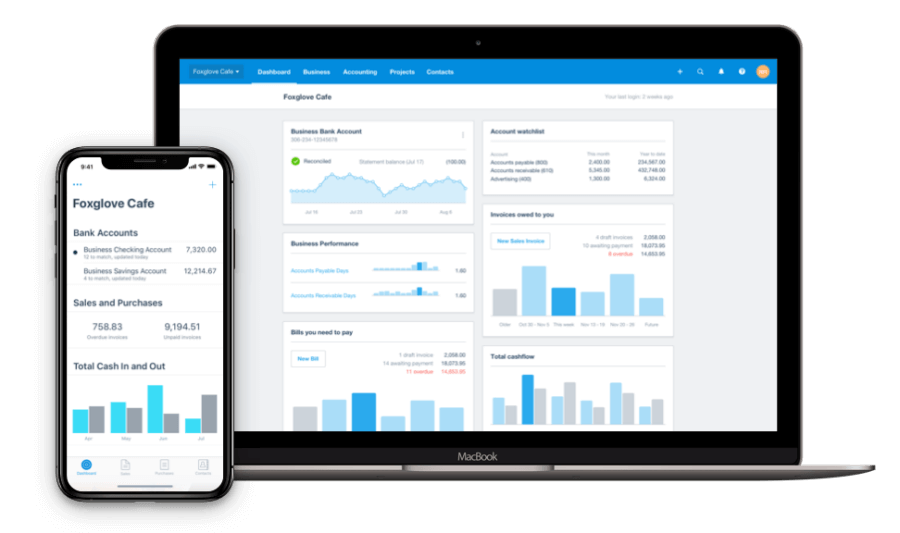

Cloud accounting software helps to manage your bookkeeping and payroll in a more efficient and consistent way. Basic functionality includes managing invoices, tracking incoming and outgoing payments, processing employee payrolls and preparing for making tax digital.

There are many different cloud accounting software providers available, use our free comparison tool below to help you decide on the best accounting software for your business.

Invoicing

For small businesses, your invoices are your lifeblood. They’re what let you keep track of the services you have to provide and the money you can expect to come in from your clients. Keeping track of them all by yourself is tiring and error-prone, so the most basic functionality of any cloud accounting app is to let you create, send and track invoices with them. Beyond this, they also usually let you set up deadlines for tasks, notify you when payments are late to come in and easily distribute quotes to customers.

Reconciliation & Receipts

Reconciliation is the act of making sure two ledgers of transactions match. Your cloud accounting software should match up with your bank account balance. In addition, this naturally entails being able to monitor transactions that hit your bank account, letting you look over past inbound and outbound expenses. Keeping receipts is important, but it’s easy to lose track of which ones you have and for which products. It’s even worse when you’re trying to organise a mix of digital and paper receipts. That’s why accounting tools often let you upload or incorporate receipts and other expenses into a central database.

VAT & Tax management

Most cloud accounting software offers easy-to-use functions that let you calculate and submit digital VAT returns. You can reconcile payments and transactions with your digital banking provider to keep track of tax owed and VAT (if applicable).

Payroll

Many cloud accounting software providers offer an additional payroll function. Another common feature is to simplify the process of paying taxes. FreeAgent for example, is strictly compliant with HMRC’s guidelines on calculating PAYE tax, making it something you essentially never have to worry about.

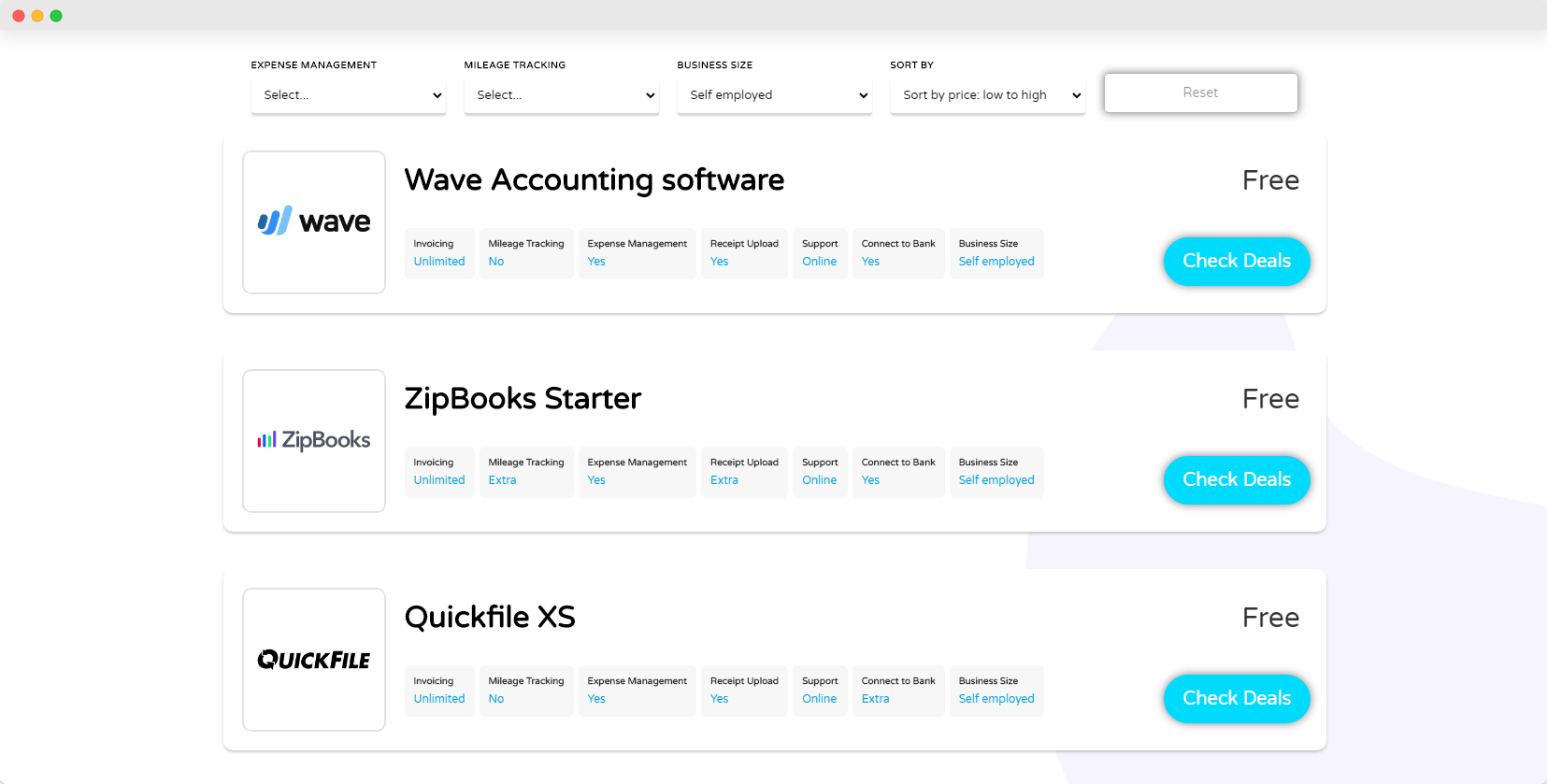

Compare the best cloud accounting software for your business.

Cloud Accounting Software Features

Here’s the core features that most cloud accounting software includes.

Certain providers include additional features and integrations. For the easiest way to find a cloud accounting software for your business, use our free comparison tool below.

Find & Compare

Cloud Accounting Software

We compare dozens of cloud accounting software to help you make the best choice for your website.

Questions?

Cloud Accounting Software FAQs

Here’s some simple, jargon-free answers.

Most accounting software is cloud-based, meaning that you don’t have to install it yourself. Instead, you can think of it as living on the internet.

When tools are cloud-based, there’s no need to manually install it on each of your business computers. This means that you merely need to set up accounts for each of your employees who’ll be using the app – which likely isn’t many, for cloud accounting software.

Once you’ve done that, all that remains is to give them the link to access the app. You won’t need to worry about any software updates or incompatibilities with your computers, because everything is hosted online.

Cloud accounting software for small and medium-sized businesses almost universally follows the standard software-as-a-service (SaaS) model of charging monthly subscription fees.

This means that rather than paying one lump sum, you’ll be charged automatically for each month you use the service. This doesn’t come with a contract, so you’re free to discontinue usage whenever you like.

Naturally, most services break their offerings into multiple ‘tiers’, which each cost different amounts. The more expensive the tier, the more advanced features or involved customer support you’ll be entitled to.

The SaaS model already makes it a lot easier to try out multiple different tools, as the initial buy-in cost isn’t very steep. Even better, though, is that most tools also offer free trial periods which you can use to judge if the software is right for you.

Depending on the size of your business, setting up cloud accounting software can take anywhere from minutes to several hours after signing up.

Small business accounting software charge a monthly subscription fee for the service, allowing you to add on extra services for an extra charge in some cases.

Most cloud accounting software providers offer a free trial so you can test-out the best one for you, before you commit.

Need some help deciding which cloud accounting software is best for you? Check out our review of the 5 best accounting software for small business.

It’s important for your accounting software to be able to talk with the rest of your software. This is usually called ‘integration’, and it means that instead of you having to manually export data from one program and feed it into another, they’ll automatically share their data.

This is important for two reasons.

Firstly, it saves you time. This is big enough by itself that you should seriously consider only using products that integrate well with your existing CRM and other digital tools.

Secondly, it reduces the chances of making a mistake. When you’re manually moving data around, it’s easy to accidentally mess it up. You might miss an entry, or add one that you didn’t mean too. With automated integrations, this will never happen: computers simply don’t make that kind of mistake.

Let’s sketch an example of what integration would look like in practice.

If you own a retail shop, you’ll likely have a till where customers can buy products. On that till, there will be a point of sale system that tracks it, updates your inventory database and – crucially – sends a message to your cloud accounting software.

The accounting software takes this message, which usually contains details of the transaction, and uses it to post an entry in your ledger. Your books remain balanced, and you didn’t have to lift a finger.

This depends on the tool.

Some accounting software solutions are specifically geared towards accountants, and can be hard to use effectively if you don’t have some level of skill with double-entry bookkeeping. Sage for example, was designed in this manner back in the 1980s.

Other providers, however, have recognised that many companies – especially small ones – don’t want to deal with the added weight of hiring expert accountants. As such, they’ve designed their programs to be easy to use for novices. Xero is an example of this design methodology.

Every business needs some form of bookkeeping so that it can self-assess and see whether or not it’s succeeding financially.

If you don’t know whether you’re in debt or pulling in profits, it’s impossible to make data-driven decisions about which direction to take your company.

Traditional accounting, however, has several flaws in the modern business environment:

- It’s difficult to learn for people unaccustomed to it

- It’s filled with repetitive and boring manual labour

- It’s easy to make small mistakes that have massive consequences (a single number in the wrong place…)

- It’s not well-suited for quickly providing a bird’s-eye overview of the state of your business

Cloud accounting software packages answer all of these points.

While some apps use the terminology and methods of traditional double-entry bookkeeping, most are designed with newcomers to accounting in mind. Their interfaces are simply and make quickly importing your existing financial history easy.

Beyond that, these programs exploit the fact that computers are extremely efficient at performing calculations on numbers to make balancing your books quicker and error-free.

If you supply it with the correct starting information, it will never make a slip of the pen or put a decimal point in the wrong place.

As a natural consequence of this, they’re well-suited for automating the repetitive actions you’d otherwise be saddled with.

If you can define an operation you want to perform on one business account, it’s usually trivial to perform the same action on five, fifty or five hundred more accounts with a few clicks of the mouse.

Finally, these programs serve to bring together lots of separate strands of information into one central location.

Besides getting rid of those dozens of messy spreadsheets littering your hard-drive, this makes it easy to produce clear, accurate financial reports which let you make more confident decisions about the next steps you want to take.

Picking the right cloud accounting software for your business is an important choice. Each app is different, and are often geared towards completely different kinds of users. Here are some of the key things you should be thinking about when you’re reviewing an app.

What level of accounting do I need? What are my skills like?

A massive international corporation has different accounting needs than an independent retailer. Many accounting products are specialised towards different business sizes, and choosing the wrong kind will likely lead to frustration as you grapple with features that aren’t relevant to you.

In addition, some tools market themselves towards specific industries. If you work in hospitality or the restaurant business, for example, Xero offers specialised plans and guides that you might find useful.

Does this integrate with my existing toolset?

One of the biggest selling points of using accounting software is that it automates sending data between different parts of your business. Naturally, that’s only useful if the accounting app supports the rest of your current toolset.

Cloud accounting apps will always list their supported integrations on their website, but some might also offer optional extensions or plug-ins created by their community which provide the integrations you need.

What do the experts say?

It’s likely that you’re not deeply familiar with cloud accounting best practices, which means it can be harder to tell which apps go above and beyond to deliver the most useful features possible.

If your team has anyone skilled in accounting, it’s a no-brainer to get their opinion on which software packages they’d prefer to use. You might not have anyone with those qualifications, of course – in which case, consider hiring a freelancer as a temporary consultant who can help with the choice and the onboarding process.

Most cloud accounting software services have similar core features, with extra features being available on more expensive plans or as additional services.

The most common accounting software features are:

- Invoicing – Create and send invoices and quotes to customers, track late payments and send reminders.

- Bank reconciliation – Connect your bank account to your bookkeeping software so you can monitor and track transactions.

- VAT management – Calculate and submit VAT returns.

- Cashflow – Manage and forecast cashflow to help make business management decisions.

- Manage receipts – Upload copies of receipts and expenses to help keep track and avoid having to file paper receipts.

- Some other features may also include HR software, project management tools and cloud storage for your documents.

Make the right choice for your business

Compare Cloud Accounting Software

Check deals for the latest offers & free trials

Clearbooks Large

£11.00

Sage Start

£10.00

Quickfile XL

£45.00

Sage Standard

£20.00

ZipBooks Smarter

£11.07

Freshbooks Premium

£9.00

Top 5 Cloud Accounting software

FreeAgent Limited Company

£14.50

Great for small businesses and if you’re self-employed.

Great for small businesses and if you’re self-employed.

Pros

- Easy-to-use

- Unlimited users on all plans

- No contracts

Cons

- Limited reporting features

- Pricing plans slightly more expensive than others

FreeAgent accounting software has excellent features, an easy-to-use platform and inventory management. Read the full review.

Sage Standard

£20.00

Sage is a comprehensive accounting software, best suited to those with experience.

Sage is a comprehensive accounting software, best suited to those with experience.

Pros

- In-depth reporting

- Cashflow and forecasting

- Integrates well

Cons

- Can be time-consuming to set-up

- Better suited to larger businesses

Sage provides some of the most detailed reports and advanced features. Whilst there are small business plans available, Sage is quite complex and may be better suited to those who have used it before. Read the full review.

Quickbooks Simple Start

£6.00

Quickbooks is designed for small businesses and is a popular choice if you’re self employed.

Quickbooks is designed for small businesses and is a popular choice if you’re self employed.

Pros

- Easy set-up

- Excellent pricing

- Change subscription at any time

Cons

- No payroll or project management included (extra)

- Limited reporting

- Better options available for inventory management

If you’re looking for cloud accounting software for a small business, Quickbooks is a great choice. Although it’s not the best for managing inventory or reporting. Read the full review.

Zoho Books Basic

£6.00

Great if you’re looking for mobile accounting software.

Great if you’re looking for mobile accounting software.

Pros

- Great pricing

- Easy-to-use

- Multiple payment gateways

- Good support

Cons

- Payroll feature is limited

- Limited accounting partners

Zoho is a great value accounting software with some very useful features. It’s perfect for those of you using the Zoho CRM system, although payroll features are limited to certain US states.

Freshbooks Lite

£3.30

Best for small businesses and freelancers.

Best for small businesses and freelancers.

Pros

- Easy set-up

- Client records

- Inventory tracking

- Double-entry accounting

Cons

- Limited customization for invoices

- No quarterly tax estimates

With Freshbooks you can send and manage invoices and estimates, handle expenses, track time and projects. It offers excellent value for money for the features you get and has great user reviews.