Find & Compare

Digital Banks

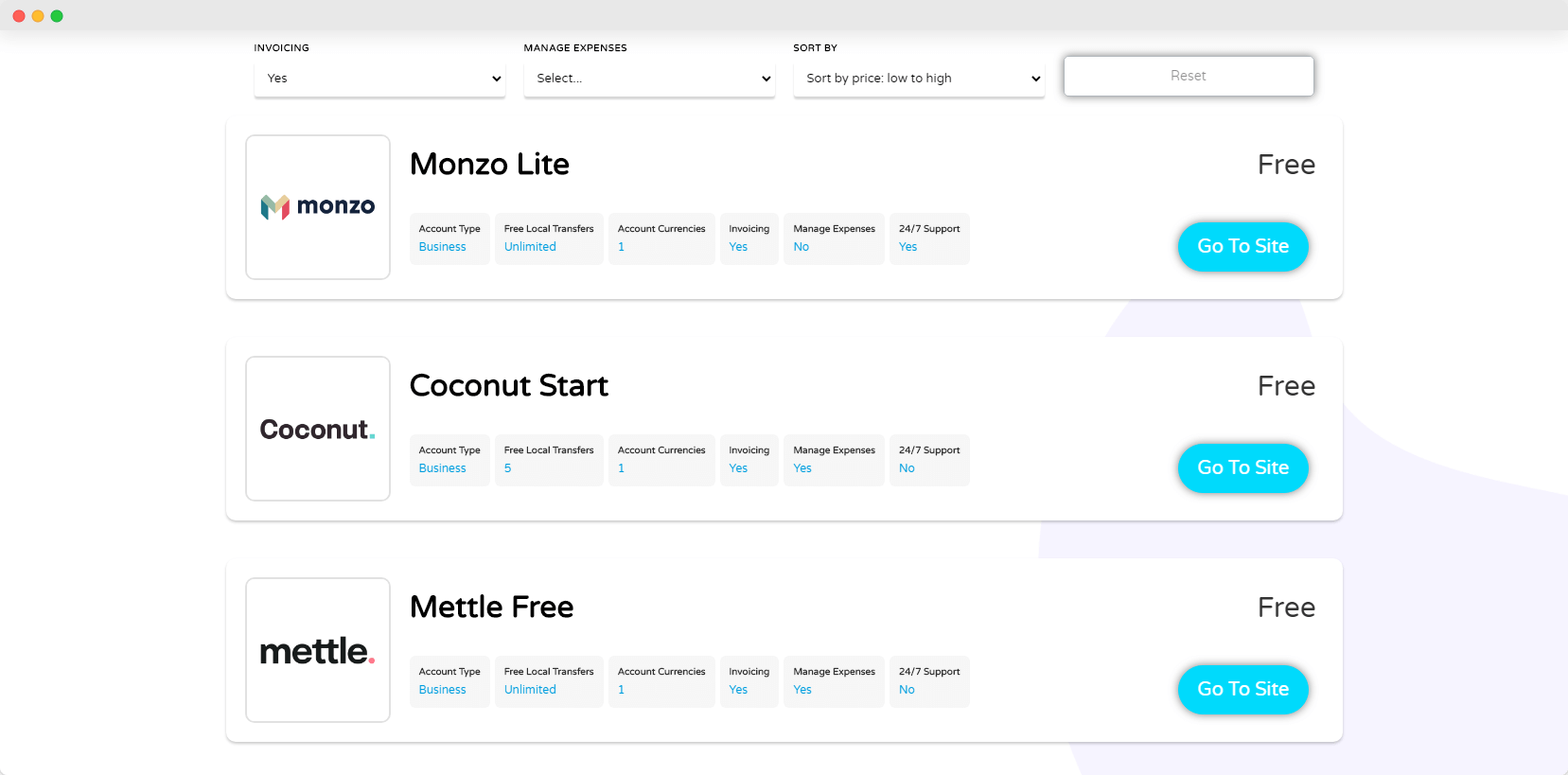

Find the best digital bank account, compare prices & features to get a great deal.

What are Digital Banks?

A digital bank account is a banking solution, often used by individuals and small businesses, that doesn’t correspond to a physical bank, it’s all online.

Digital banks offer fast account opening through the app, features for business – such as expense management, and offer cost-effective currency exchange.

Thinking of switching business bank accounts? Make sure you compare fees and features to find a digital business account that works for you.

As everyone’s needs are different, we have specific guides to digital banking as well as our free digital bank comparison tool below.

Multi-currency management

Currency conversion and its associated fees are a sore point for any business that trades internationally. Digital banks regularly simplify this process by allowing accounts to hold balances in multiple currencies at once—28, as you can with a Revolut account. This means you can receive and send payment in foreign currency without ever having to deal with conversion rates. And when you do, most services offer conversions at ‘interbank’ values—zero markup, in other words.

Budgeting and financial planning tools

Most digital bank accounts allow you to manage your expenses, spend using a debit card, exchange currency, and even invest in stocks and exchange cryptocurrencies. Digital banks offer a range of money management features, letting you set up spending plans, limits and targets. A Monese account, as an example, will even generate detailed reports of your spending habits so that you can identify potential waste more easily.

Integration

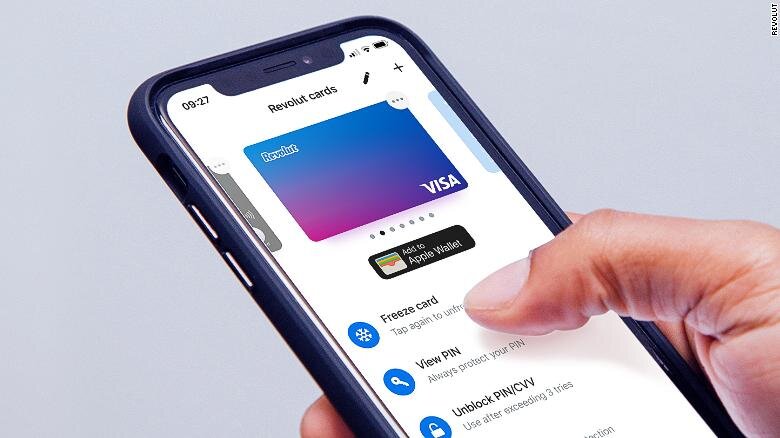

In addition to offering their own contactless payment methods, such as cards or smartphone apps, most digital banks can integrate with ePOS systems and online payment gateways as well as Google Pay or Apple Pay. Digital bank accounts will most always integrate with your cloud accounting software provider, so you can reconcile transactions and payments.

Card freezing

As for cyber security, digital banks typically allow you to ‘freeze’ a credit card or account, meaning it can’t be used for any purchases until you unfreeze it. This is an important anti-theft measure—if you lose your card, you can use the bank’s app to freeze the card until you get it back, wherever you are. This means no more time wasted reversing frivolous transactions: you can block them before they even happen.

Choose the best digital bank account.

Digital Banks Features

Beyond the basics of digital banking, like seeing your current account balance and making transfers, fully digital banks are able to offer services not found with traditional outlets.

Many of these features are useful for businesses, but can take some getting used to.

Find & Compare

Digital Banks

Use our digital bank comparison tool below to find the right account for you.

Questions?

Digital Banks FAQs

Here’s some simple, jargon-free answers.

It depends on which digital bank you store your money with.

‘New banks’ like Starling have fully-fledged banking licenses.

In the U.K., this means that the FSCS will cover up to £85,000 of your money should the bank go bankrupt. This is exactly the same as with traditional banks.

Other kinds of digital banks, however, aren’t covered by the FSCS.

While they offer other measures of protection, they might not be backed by law.

Yes! Digital banking is incredibly secure. Vast amounts of money and effort have been invested in keeping the process safe from fraud and technical issues.

One of the primary ways banks ensure security is through two-factor authentication, also known as 2FA.

This essentially means that to make a transaction, you need to both give your password and answer a message sent to your smartphone.

This adds some extra hassle to doing business, but it makes it almost impossible for someone to break into your account without stealing your phone.

And even if that happens, there are apps for wiping a phone remotely to clear it of all personal data.

When making any financial transaction online, we recommend using a VPN service for extra security. Compare VPNs to find what’s best for you.

Yes. Most new accounts can be opened on the app and use digital face recognition software to verify your identity.

The Current Account Switch Service may not be offered as it is with traditional business bank accounts, but this may soon change.

This is a service where your old and new bank will route incoming payments to the right place, including direct debits and standing orders.

Check out this guide to switching business bank accounts

It’s easy to get confused by the similar language, and in many cases the two things overlap.

There is, however, an important distinction.

Online banking

Refers to any system where you can use some banking features online. A traditional, brick-and-mortar bank might have an online portal where you can check your balance, pay for things online or send money to friends.

Digital banking

Digital banking goes much further. Rather than a normal bank that just has an online page, digital banks are designed to work online ‘from the ground up’.

They have no physical offices or branches—it’s all in the app. In practice this means many more features are available online, such as applying for credit cards, financing loans or opening new accounts.

Digital banking is an industry-wide push to make the core functions of banking available online. Even some traditional banks are slowly moving towards this model.

Here’s our guide to the best digital banks UK and the best business bank account (with traditional banks).

Support is typically given through in-app live chats with members of the bank, along with traditional phone lines in case of issues with the app.

Sometimes customers paying for more expensive plans get special treatment— the Revolut Premium and Metal plan users get priority service, for example.

Yes, although you might not need to. Some startups use digital banks as the apps offer useful business technology which help to run a business day-to-day.

Larger business that need an overdraft or loans facility or other services a traditional bank can provide, will tend to stick with a mainstream banking provider.

A typical use case might be transferring a set amount of cash every month from one account to the other as a form of budgeting.

You could also use a digital bank account for features such as basic bookkeeping, or creating invoices and tracking customer payments.

Use our digital banks comparison feature below to find the best deal for you!

Alternatively, check out our review of the 7 best digital bank accounts and the best business bank account for startups.

If you’re making the most of the revolution of remote working, or plan to run your online business abroad, check out this guide to the best business bank account for digital nomads.

The most important distinction when it comes to digital banks is whether or not they have a full banking license.

This determines what range of services they can offer and whether your money will be protected by the FSCS.

For businesses just looking to dip their toes into the water of fully-online banking, a ‘new bank’ like Starling is a safe choice.

Beyond that, you should consider what features are most important to you.

If you only intend to use digital banking as a way to make transactions with clients or other companies easier, then the speed and simplicity of nonbanks or neobanks might be what you need.

In general, it’s important to remember that this is a new field, yet to stabilise, that comes with complex requirements for the banks: new legal regulations, a new emphasis on cyber security and radical mix-ups in how they work internally.

For that reason, it might be best to stay away from digital banks that have only sprung up recently, especially if they’re not FSCS-protected.

Did you know that some digital banks also have a crypto trading feature? Some accounts also act as trading platforms allowing you to buy and sell stocks.

There are three basic kinds of digital banks. The differences mostly concern what licenses they have and what services they’re legally allowed to offer.

New banks

Digital banks with full banking licenses are usually called ‘new banks’. They work as direct competitors to traditional brick-and-mortar banks, and can offer all of the services that they do. Revolut and Starling are examples of new banks.

Neobanks

Neobanks don’t have a full banking license, meaning they can’t independently offer many of the services that new banks do. They typically work by partnering with financial institutions and existing banks to offer more user-friendly services or cut out transaction fees.

Nonbanks

As the name suggests, nonbanks like Monese have no relation to traditional banking at all. Instead, they use electronic money licenses or similar provisions to allow payments or track your spending.

Sometimes, they’re also called Alternative Financial Services, or ‘AFS’. Notably, AFS aren’t supervised by financial watchdogs in the same way banks are. This can have important ramifications in how they can guarantee your money’s safety.

Check out this guide if you’re looking for business credit cards.

There are many reasons for a business to consider switching to a digital bank for business rather than a traditional business bank account.

If you’re setting up a new business, opening an account with Tide will enable you to open a limited company in the UK at the same time.

For growing businesses, digital banks such as Mettle offer free accounting tools.

Here’s some benefits of digital business bank accounts:

Convenience

Bringing more traditional banking services fully online is especially important for businesses, who often need greater flexibility than simple money transfers or account statements. With digital banking, it’s easier to set up transfers in advance, organise repeat deposits or send invoices for clients.

In addition, most banks offer smartphone apps that allow you to manage money on the go, rather than just at your desk or a physical branch. As you’ll see from this digital banks comparison, most accounts will integrate with your accounting software provider, and as well digital tools such as productivity apps and CRM, which helps the flow of information throughout your business. If you’re using a point of sale system to take payments from customers, this will link to your digital bank account to enable you to receive payments.

Some digital bank accounts have features that enable you to calculate self assessment tax and profit and loss reports.

Low Cost

Many digital banks market themselves on reducing or even cutting the fees associated with traditional banking. A cheque, for example, can cost several pounds more to process than digital payments.

The difference can easily add up to hundreds of dollars after only a short period of business. In addition, the convenience and efficiency of digital banking means less overhead on the administrative side of things. Automated payment services can handle transactions for multiple accounts at once, meaning there’s less need for human oversight or accounting.

Eco-Friendly

Going paperless on your finances can have a big impact on your environmental footprint. Rather than wastefully keeping records of past transactions, you can simply call up a digital record whenever it’s required. As a nice bonus, a lack of paper records means it’s much easier to create a ‘single source of truth’ for your company’s finances. There are no outdated or conflicting records when accounts are automatically reconciled by internet services.

Most digital banks do not provide an option for a business credit card. These are normally provided by traditional banks or credit card providers specifically. Digital banks do provide debit cards (usually Visa) to enable you to transact using a card.

Make the right choice for your business

Compare Digital Banks

Check deals for the latest offers & features.

Tide Plus Cashback

£49.99

Tide Plus

£9.99

Monzo Lite

Free

Revolut Scale

£100.00

Top 5 digital banks

Tide Free

Free

Tide bank is great if you’re just starting a business and won’t be accepting frequent payments.

Tide bank is great if you’re just starting a business and won’t be accepting frequent payments.

Pros

- Set up a limited company when you open an account

- Easy-to-use app

Cons

- Not recommended for receiving international payments

- Slow payment processing

- Account fees

- Slow customer support via live chat

Tide bank is a great choice of digital bank if you’re starting a business as you can open a limited company in the process of opening your account, and they pay the companies house fee! Although once you start trading, the fees and slow payment processing make other digital banks more attractive.

Mettle Free

Free

A free business bank account from Natwest with great features and free accounting software.

A free business bank account from Natwest with great features and free accounting software.

Pros

- Fast account opening

- Apple and Google payments

- Create invoices and reports

- Free accounting tools

- No account fee

Cons

- No overdraft facility

- No FSCS protection

Apply for an account to be opened in minutes, get free accounting software from FreeAgent and take payments. As there’s no account fees involved, Mettle represents outstanding value for money for small businesses looking to open a digital bank account.

Coconut Start

Free

Integrated business tools, ideal for freelancers and entrepreneurs.

Integrated business tools, ideal for freelancers and entrepreneurs.

Pros

- Bookkeeping tools built-in

- Easy-to-use app

- Great business features

Cons

- 2% currency conversion fee

- Cash withdrawal fee

- Monthly invoices are limited with free account

- Not FSCS protected

Manage invoices, make payments and manage tax all from the app. It’s quick and easy to open an account, although better options are available for businesses trading internationally.

Monzo Lite

Free

Monzo’s free business account.

Monzo’s free business account.

Pros

- FSCS protected

- No ATM charge up to £400/day

- Current account switch guarantee

Cons

- No overdraft

- Accounting software integration with paid plan only

- Charge to deposit cash

Monzo is highly rated by customers and comes with FSCS protection – which most of it’s competitors don’t have. Other digital banks have better business management tools, but this account would suit you if you’re already using a Monzo current account. Check out the full Monzo review.

Revolut Free

Free

Integrates well with other business tools.

Integrates well with other business tools.

Pros

- Use your account in 28 currencies

- Business account has payroll features

- 24/7 live chat support

Cons

- No FSCS protection

- Free account limits amount of payments

- 2% charge on ATM withdrawals

Revolut is a great choice if you’re looking to move money or spend abroad. The app is easy-to-use and they provide excellent customer support via live chat. Read the full Revolut review.