The government regularly releases policies and plans that affect UK businesses, sole traders, and the self-employed. One of the biggest policies in recent years is the Making Tax Digital plan. This scheme aims to transform the way that UK businesses keep records and submit their tax returns. This guide will help you understand digital tax accounts and making tax digital.

Quick find…

- Why have digital tax accounts?

- Information on making tax digital

- Digital Tax Accounts for Business

- Digital Tax Accounts for Sole Traders

- Digital Tax Accounts for Corporations

- Digital Tax Accounts Software

- Making Sure You’re Compliant

Why Have Digital Tax Accounts?

HMRC and the UK government have introduced the Making Tax Digital policy for a number of reasons. We feel that it is a step in the right direction and should ultimately make tax paying easier for businesses, and more environmentally friendly.

The emphasis is on a shift to digitalization with a reduction in the use of paper, and a tax system that links digitally to HMRC.

The aims of the policy include:

- Transforming to a paperless tax system

- Becoming one of the most digitally advanced tax systems in the world

- Creating a more efficient tax system for businesses

- Creating a system that is easier for businesses and sole traders to get right

Primarily, the government aims to transform HMRC into a paperless administration. They want the UK to lead the way in digitalization for businesses. This, in turn, should also prove highly beneficial for businesses, sole traders, and VAT-paying companies.

The tax system, filing, and making payments should be easier. Records should be more accessible via digital means, and a reduction in paper use is always a good thing.

Information On Making Tax Digital

Government policies are often highly detailed and can be difficult to understand. The MTD policy follows this trend and it has a range of different considerations for different types of business. To help, we have provided some links to information websites for help on Making Tax Digital:

- Official Government policy overview of MTD

- Official Government MTD Review

- VAT Record-Keeping Guides for MTD

- Government help and support material for MTD

The official government website is the best source for current information. The support page in particular has a wealth of different guides and material for small businesses that need to make the digital transition.

Digital Tax Accounts for Business

The scope of making tax digital is broad and applies to many different types of UK businesses. We have broken this down into three main sections so you can pick out which part of the Making Tax Digital policy applies to your circumstance:

Making Tax Digital for VAT

There is a specific part of the policy for businesses that are registered for VAT.

Who it applies to

- VAT-registered businesses with a turnover taxable of £85,000

- Businesses below this threshold can also voluntarily sign up for MTD

MTD Requirements for VAT-registered businesses

- Must keep digital tax records

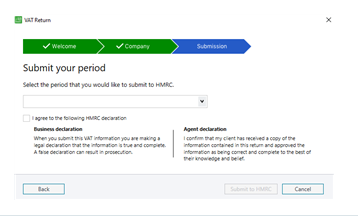

- Must use digital software to submit VAT returns

This is relatively straight forward and many businesses will already be using digital software for tax submission and record keeping. The digital records a VAT-registered business must keep include:

- Business contact details and name

- VAT details such as number, schemes, and VAT for purchases made and received

- VAT rate charged on supplies made

- Essentially anything to do with VAT

The easiest way for small businesses to manage digital tax accounts is with a cloud accounting software or digital bank account that has a bookkeeping function.

Examples of software to use are listed below. It should ideally be software that can automatically pull data from your records to use in your VAT return submissions. This improves the efficiency of VAT returns and should leave less room for human error.

Digital Tax Accounts for Sole Traders

Making Tax Digital is slightly different for sole traders and landlords – those who pay income tax (self-assessment). As there are no VAT requirements, the MTD process concentrates on recording keeping, submissions to HMRC, and your annual self-assessment return.

The following are important details relating to MTD for sole traders and landlords:

Who it applies to

- Sole Traders and Landlords who make over £10,000 per anum

- Compliance for sole traders is not required until 2024

MTD Requirements for Sole Traders

- Must keep a record of digital tax accounts

- Must use digital software to submit self-assessment returns

- Send income and expenses summaries every three months to HMRC

- Send your final tax report at the end of each financial year

Until April 2024, there is no requirement for sole traders or landlords to comply with the Making Tax Digital Scheme. However, many people are doing so voluntarily regardless. The government estimates that 30% of sole traders have already done so.

The government has provided a signup page complete with a wealth of information for sole traders and landlords if you want to start the process before the deadline. We do not see the harm in doing this before the deadline – it gives you chance to get used to the system and to make sure you have everything in place ready.

Digital Tax Accounts for Corporations

Corporation Tax is a UK government tax on profits that businesses make each year. This generally applies to much larger businesses with a greater annual turnover and profit. For example, there are brackets that apply to businesses that make an annual profit of £300,000 or more.

Currently, the government has not made any definitive plans for Making Tax Digital for Corporation Tax. They have published an initial consultation that outlines their potential path and invites input from large UK corporations.

The only definitive policy in place for Making Tax Digital for Corporation Tax is that businesses will be given the opportunity to take part in an MTD pilot for corporation tax in 2026. Also, it is stated that no policies will be mandated before this year.

Digital Tax Accounts Software

The software you use is an important aspect of the Making Tax Digital policy. Software is required to reduce paper consumption, improve efficiency, but also to provide a direct link between HMRC systems and your business. This, in theory, should greatly improve the efficiency and accuracy of the tax and VAT submission process.

As per the above, businesses will be required to use compatible accounting software to file their tax returns and VAT returns. This doesn’t have to be a single program – you could use a program for accounts records, and a separate program for tax submission, for example.

The main requirement is that the software provides some means of linking your data to HMRC, this can include:

- Via emails

- Via direct linking to cells in spreadsheets

- Via the downloading and uploading of files

The software must also be compatible with the HMRC tax authority. To help, HMRC has provided a list of software that is compatible, this includes:

- Quickbooks – Check out our Quickbooks review

- Zoho – Check out our Zoho review

- Xero – Checkout our Xero review

- Sage – Checkout our Sage review

The list is extensive and we are confident you can find software to suit your business needs. The main downfall here is the additional cost your business will incur to use the software.

For example, unless you can find free software, there will be either a one-off license fee or a monthly subscription fee. In addition, you will have to either learn how to use the software yourself or pay for training to train an employee to use the software. You may even need to hire an accountant to complete these processes for you.

This will undoubtedly affect small businesses, self-employed people, and sole traders. The government estimates that this will only cost small businesses £70 per year to implement digital tax accounts. However, many experts feel this is a vast underestimate and that a more realistic annual cost is £1,250.

Make Sure Your Business is Compliant

It is important that you research the making tax digital policy fully as UK businesses are expected to be compliant with set deadlines. We advise spending time reading through the government data and information, and dedicated time to updating your business to make sure that you are compliant.

If you are unsure of anything, or require further help, seeking the services of a qualified accountant should be a great move. Anyone dealing with taxes for businesses should be fully aware of the making tax digital policy and how to help businesses achieve compliance.

Deadlines for UK Business

There are also two important deadlines to be aware of listed below:

- Making Tax Digital for VAT: Started on 01/04/2019 – All VAT-registered businesses must be compliant before April 2022 i.e. the new tax year.

- Making Tax Digital for Self Assessment: All sell assessment taxpayers must be compliant before April 2024.

- Making Tax Digital for Corporation Tax: No plans outlined, and at the earliest, policies will take effect in 2026.

The government has already moved the deadline for self-assessment back to April 2024 as this was originally scheduled for 2023. This was to help self-employed people during the pandemic.

We hope you have found this guide to digital tax accounts and making tax digital useful. It is vital that you understand exactly what is involved and prepare your business before the deadlines.

Check out our how to pay self assessment tax guide or compare digital tax accounts software below.